For many North American portfolio managers, the past several quarters have proved extremely challenging. 2022 witnessed the worst return from a simple 60/40 portfolio of any year since 2008 in both the U.S. and Canada. Moreover, interest rates have continued to march noticeably higher in 2023, and equity performance has been narrow and recently started to trend down.

Nevertheless, for portfolios being managed with the core objective of funding future obligations (e.g., pension plans, insurance portfolios, retirement pools, foundations, etc.), these headwinds have been considerably less concerning. These managers are more concerned with the level of portfolio assets versus the value of future liabilities. However, as higher interest rates have meaningfully reduced the present value of those future obligations, the aggregate financial position for owners has substantially improved.

Improved Solvency Calls for Action

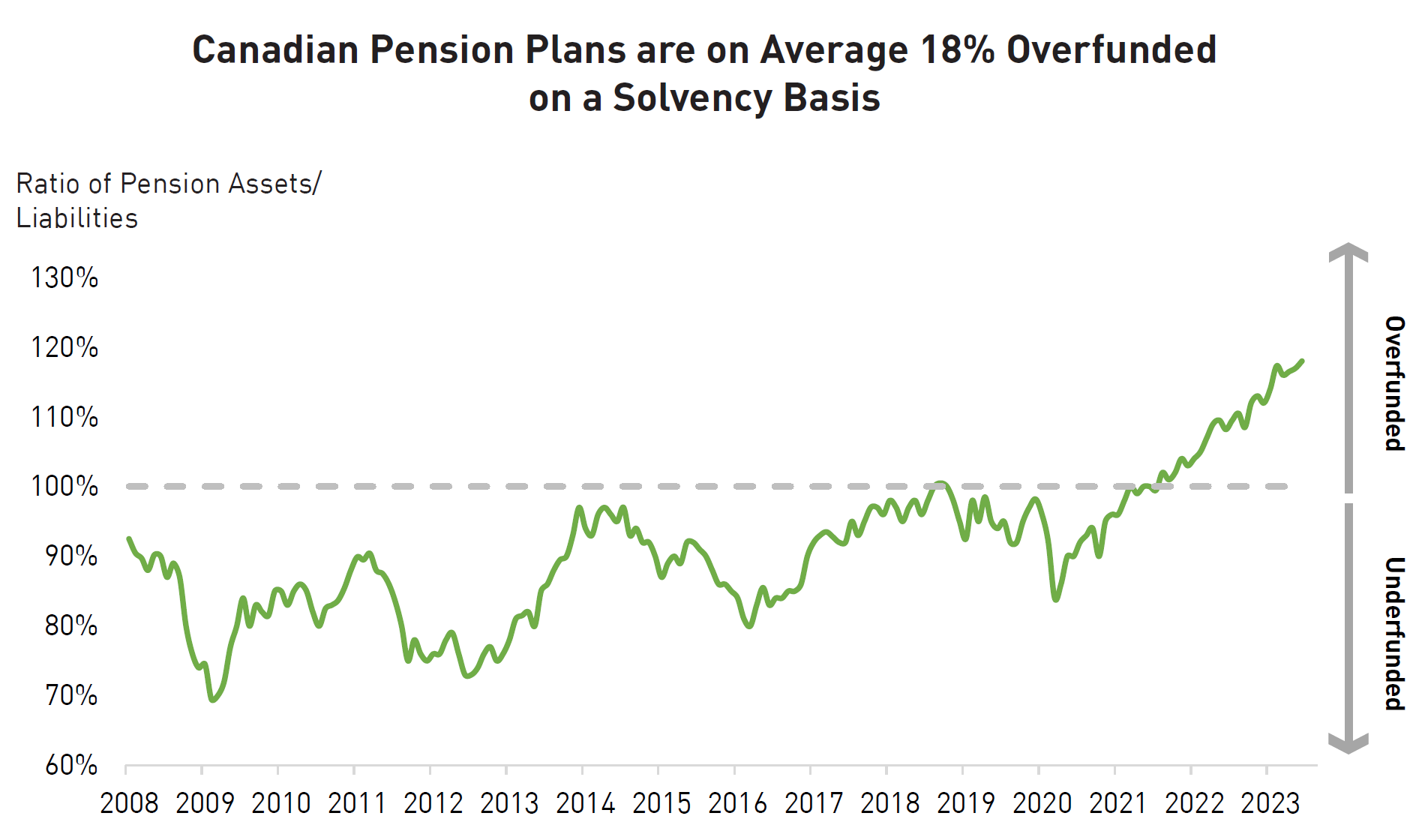

The Mercer Pension Health Pulse - which tracks the solvency ratio of the pension plans in their database - shows tremendous improvement, especially over the last few years. In other words, Canadian pension plans are better funded today than they have been in many years. At the end of the second quarter of 2023, 85% of the plans in Mercer’s database were estimated to be in a surplus-funded position on a solvency basis (i.e., their assets were greater than their discounted future liabilities). Plans were, on average, almost 20% overfunded – a massive reversal over the last three years.

Source: Mercer. Data as of June 30, 2023. Index used for chart = Mercer Pension Health Pulse. The database contains information on almost 500 pension plans across Canada in every industry, including public, private, and not-for-profit sectors. The information for each pension plan in the database is updated every time a new actuarial funding valuation is performed for the plan.

For pension plans, there is limited upside to being over-funded but clear downside consequences if the plan falls back into an under-funded position. An over-funded position combined with the existing macroeconomic uncertainty and the highest 10-year government yields since 2007 should prompt plan managers to consider fine-tuning their liability-aware investment strategy to safeguard their gains.

Segmenting the Pension Portfolio

Traditional investment strategies focus solely on generating a specific rate of return by building a diversified return-seeking mix of assets. In comparison, a liability-aware (or liability-driven) approach also explicitly focuses on improving the relationship between the value of the portfolio’s assets and the present value of current and future liabilities. This is normally done by segmenting the portfolio into a return-seeking bucket and a liability-hedging bucket.

The goal of the former bucket is to deliver a long-term return higher than the liability discount rate. The liability-hedging bucket may also deliver some return, but the principal role is to ensure risk characteristics similar to those of the plan’s liabilities. The objective is to minimize risks that could meaningfully affect the difference between asset and liability values, especially the risks associated with interest rate fluctuations and market volatility. Simply put, the role of the liability-hedging bucket is to minimize the volatility of the plan surplus.

One Size Does Not Fit All

When it comes to liability-driven investing, there is no single “right” approach – and plans need to think carefully about the varying needs of their plan members in conjunction with a whole host of other considerations. Undertaking periodical analysis (especially when the interest rate environment changes) constitutes an important part of a proper investment management process. Fine-tuning a liability-driven investment strategy can be broken down into three key steps:

1. Understanding Plan Owner Needs

Individual plan owners have varying needs based on the mark-to-market value of liabilities to be hedged, plan status, risk appetite, inflation considerations, ongoing service costs, contribution rates, etc. Although it is impossible to closely mimic the behavior of a discounted liability stream at a reasonable cost, reviewing these types of considerations will assist in determining the desired proportion of the portfolio allocated to return-seeking assets versus liability-hedging assets.

2. Defining Goals and Portfolio Composition

Funded status should be the key driver of the intent and composition of a liability-hedging portfolio. For lesser-funded plans, the relative size of this component may be moderate, with a greater focus on efficiently hedging the overall interest rate risk of the liabilities. For well-funded plans, the focus can be on more closely matching the duration and key-rate duration of the liabilities.

However, beyond funded status, the same range of considerations noted above will also assist in deciding what asset classes are used to populate the liability-hedging bucket. For example, a more risk-averse plan may use only government and provincial bonds in the liability-hedging bucket, whereas a less risk-averse plan may embrace corporate bonds and certain private credit strategies. These considerations will also feed into the decision of how to implement these investments (for example, either directly or with interest-rate derivative overlays).

3. Dont Set It and Forget It - Dynamically Hedging Interest Rate Sensitivity

With interest rates at current levels, it is worth beginning by comparing the plan’s estimated sensitivity to small interest rate changes (Liability DV011) to an estimate of the interest rate sensitivity of the liability-hedging assets in the portfolio (Hedge DV01). This allows managers to reassess the desired target hedge ratio (the ratio of the two DV01s) and then evaluate the overall investment strategy relative to this ratio.

The Role of Active Credit Strategies

The target hedge ratio for most plans has been less than 100%, meaning that it has been impractical to meaningfully hedge the rate sensitivity of liabilities. However, with interest rates where they are now, we believe it makes sense for plans to increase the target hedge ratio by adding additional fixed income exposure to the portfolio.

Furthermore, we would recommend plan sponsors increase their fixed income exposure by allocating to actively managed corporate bond strategies. Strategies of this type can meet liability-hedging needs while also delivering more return than passively managed strategies or those focused only on government and provincial bonds. This can “soften the blow” when plan sponsors are reducing their allocation to return-seeking strategies. There is the potential for additional return from the credit risk premium as well as alpha from active management. Within the category of actively managed corporate bond strategies, there is a spectrum of approaches that plan sponsors can consider based on the specific needs of their plan.

The Right Time to Optimize a Liability-Driven Approach

Periods of adversity generally also produce opportunity, and the current environment is no exception. The path of interest rates is difficult to forecast, especially during times of heightened policy uncertainty. Today, plans are better funded than they have been in many years. In addition, we are seeing high-quality fixed income assets offer the best return potential in nearly fifteen years and also offer diversification and liability hedging benefits that will serve investors well should a recession develop. We believe this backdrop suggests that strategically repositioning portfolios for a higher-rate world should be time well-spent for plan managers.

Please feel free to reach out to a member of RPIA’s Institutional Client Team if you would like to learn more about the role Active Credit can play in a liability-driven approach.

1DV01 is a measure of the change in price, in dollars, for a one basis point change in interest rates.

Important Information

The information herein is presented by RP Investment Advisors LP (“RPIA”) and is for informational purposes only. It does not provide financial, legal, accounting, tax, investment, or other advice and should not be acted or relied upon in that regard without seeking the appropriate professional advice. The information is drawn from sources believed to be reliable, but the accuracy or completeness of the information is not guaranteed, nor in providing it does RPIA assume any responsibility or liability whatsoever. The information provided may be subject to change and RPIA does not undertake any obligation to communicate revisions or updates to the information presented. Unless otherwise stated, the source for all information is RPIA. The information presented does not form the basis of any offer or solicitation for the purchase or sale of securities. Products and services of RPIA are only available in jurisdictions where they may be lawfully offered and to investors who qualify under applicable regulation. “Forward-Looking” statements are based on assumptions made by RPIA regarding its opinion and investment strategies in certain market conditions and are subject to a number of mitigating factors. Economic and market conditions may change, which may materially impact actual future events and as a result RPIA’s views, the success of RPIA’s intended strategies as well as its actual course of conduct.