YTD 2022 has been an extremely challenging period for fixed income investors as central banks have commenced tighter monetary regimes to combat persistently high inflation. In response, bond yields have spiked, sending bond prices sharply lower, given the classic inverse relationship.

The upside to this challenging scenario is that the upheaval in yields has created an opportunity for fixed income investors to purchase bonds and GICs at the most attractive yield levels in many years. In response to the increase in GIC yields, investors are wondering if they should utilize GICs instead of bonds as a source of safe income. But are they the best option?

This article considers the different roles that bonds and GICs play in a portfolio, along with potential advantages and disadvantages to consider when making an allocation. At this juncture, there are three key reasons why investors should favour bonds over GICs:

- Greater Return Potential

- Tax Efficiency

- Superior Liquidity

The Role of GICs and Bonds in Portfolios

Investors may hold GICs and bonds for a variety of purposes, including:

- A long-term strategic allocation that provides income and stability

- A transitory placeholder that will be invested in higher return-seeking assets in the future

While the use case is often lumped together, it is essential to view these asset classes as distinct. GICs have historically been utilized as a transitory allocation to provide a risk-free level of income while also generally guaranteeing a low or negative real return. The recent market volatility has made investors believe that GICs can be a substitute for bonds over the long term.

However, bonds can play a more robust role in a portfolio. Historically, bonds have provided better total returns due to higher yields, capital appreciation opportunities, and tax efficiencies without sacrificing long-term capital preservation or liquidity.

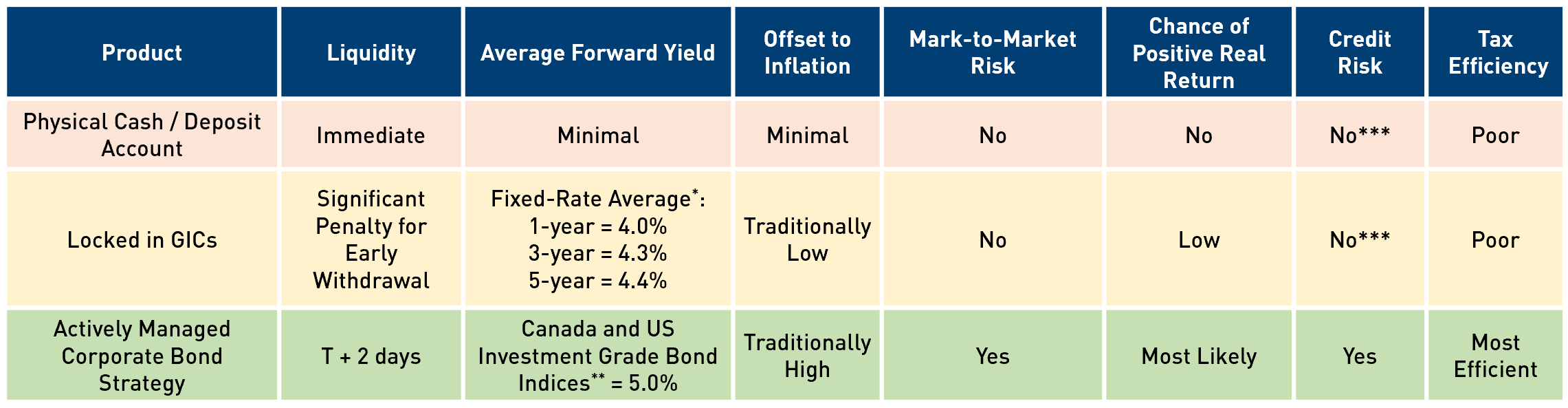

The table below compares some key attributes to consider when comparing the two:

*Based on GIC rates compiled by RBC Dominion Securities Inc. as of September 7th, 2022.

**Based on the yield of the FTSE Canada All Corporate Bond Index and the Bloomberg US Corporate Investment Grade Index as of September 6th, 2022.

***Note that the CDIC only insures up to $100,000 per insured category at each CDIC member financial institution.

Bonds Preserve Capital and Provide Better Returns

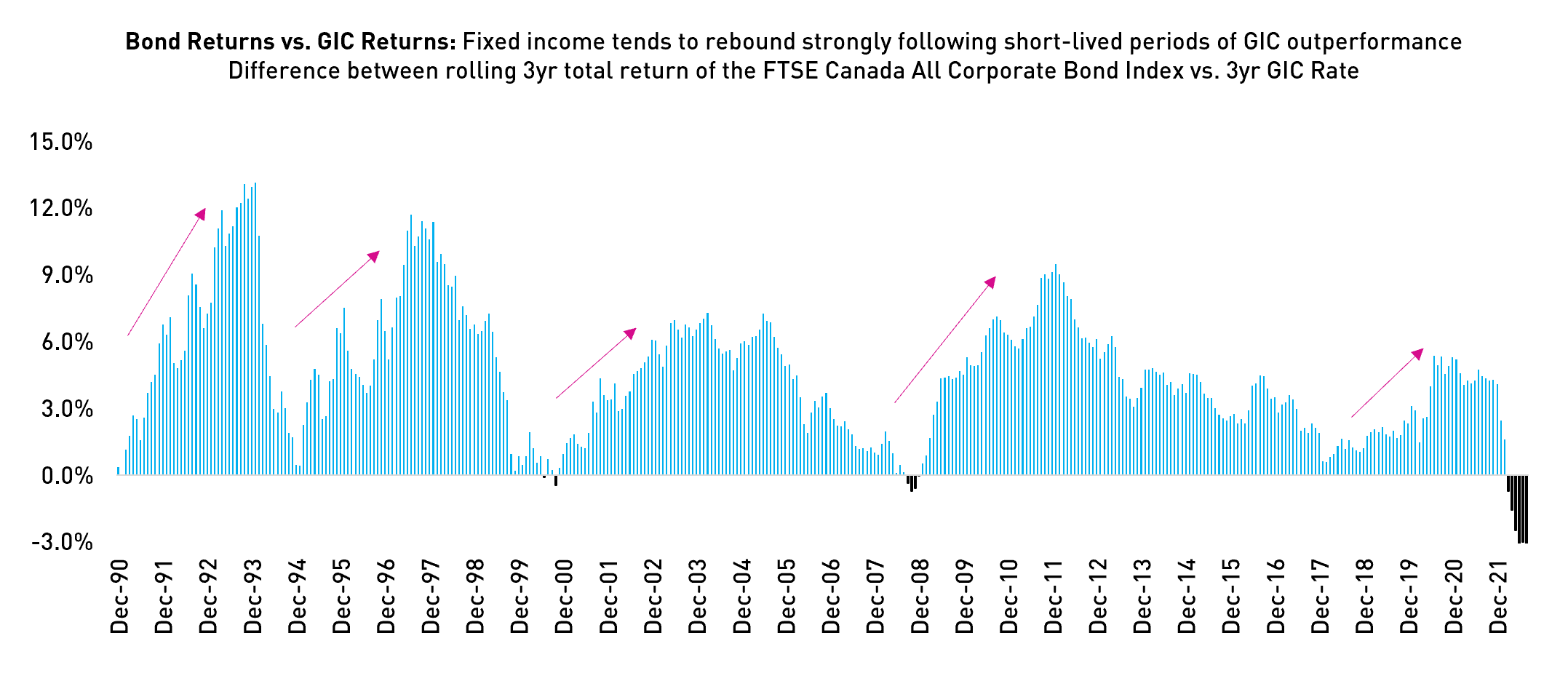

Over any reasonable time horizon, the historical return of the FTSE Canada All Corporate Bond Index has eclipsed the return on the average 3-year GIC rate. This is particularly true after bond markets experience volatility and reprice lower due to the tailwind of higher yields and more considerable capital appreciation opportunities.

The chart below illustrates that investors pay significant opportunity costs, especially in the long run, when they are lured into investing in GICs after periods of market volatility

Source: FTSE Russell, Bank of Canada. Data as of August 31st, 2022.

GICs Never Go Down But They Also Never Go Up

One of the main reasons bonds outperform GICs over longer periods, such as 3 and 5 years, is that bonds are largely “self-correcting.” The flexibility to capture higher running yields as yields increase and prices decrease enables investors to retrieve some of that lost capital. GICs’ inherent aversion to mark-to-market risk is alluring, but remember, an investor forgoes the ability to capture higher yields when they lock in the prevailing GIC yield.

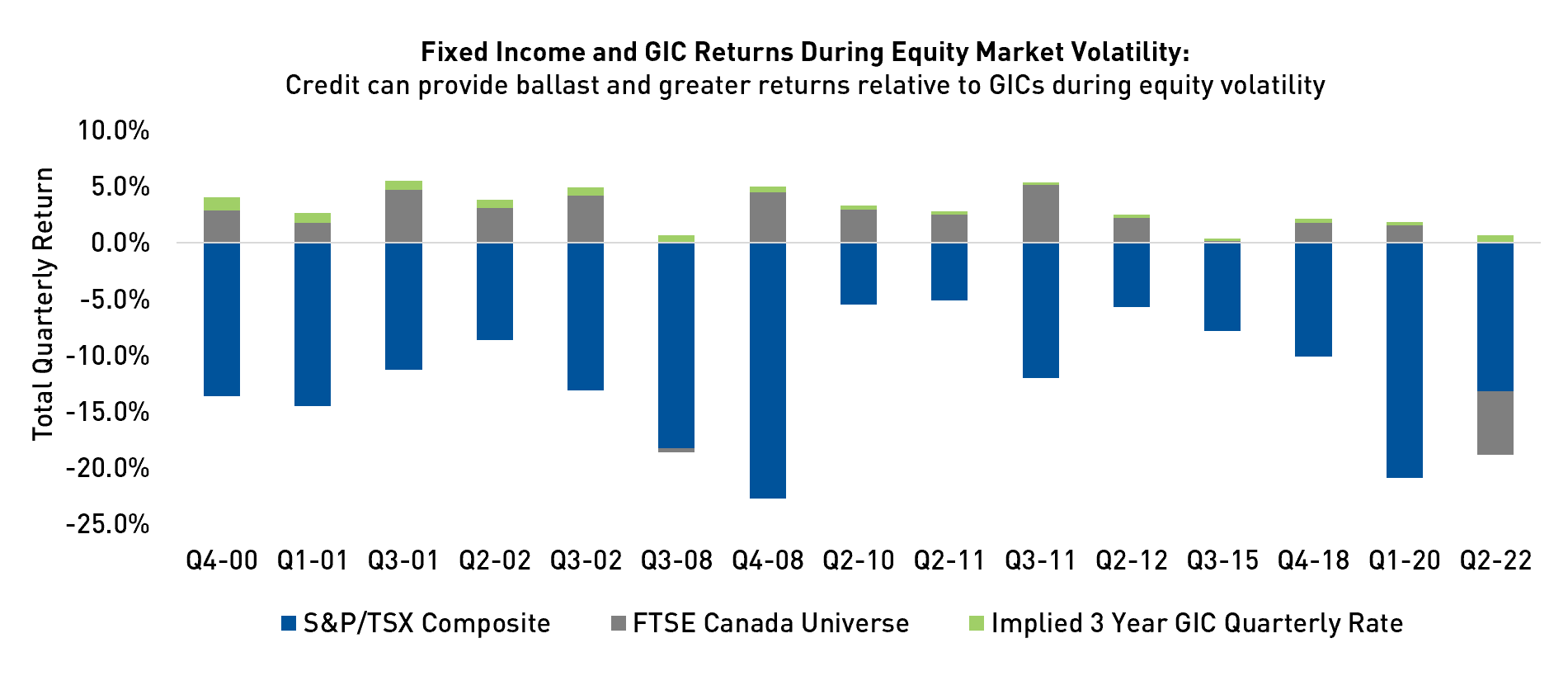

In addition, bonds can play an active role in protecting capital when equity markets experience drawdowns. It is easy to get caught up in recency bias and believe that bonds and equities will continue to lose money together, as is the case today, but traditionally, this has not been the case.

Source: Bank of Canada, FTSE Russell, S&P Global. Data as of June 30th, 2022.

Canadian equities have lost more than 5% in 15 quarters since 2000. The average quarterly return of Canadian equities, bonds, and GICs during these quarters are:

- S&P/TSX Composite = -12.2%

- FTSE Canada Universe Bond Index = +2.1%

- 3-Year GICs = +0.6%

Overall, bonds tend to provide an inversely correlated return stream to equities and insulate investors' portfolios during times of equity turmoil, while also outpacing the return of GICs.

Discounted Bonds Retain More Yield After Taxes

An important consideration when calculating total returns is the need to adjust for taxes. GIC returns are sourced 100% from coupon payments, which are taxable in non-registered accounts at an investor’s full marginal tax rate.

On the other hand, a bond’s total return consists of both interest/coupon payments and capital appreciation, which can be more tax-efficient, particularly when purchased at a discount to its original issue price (usually $100 Par).

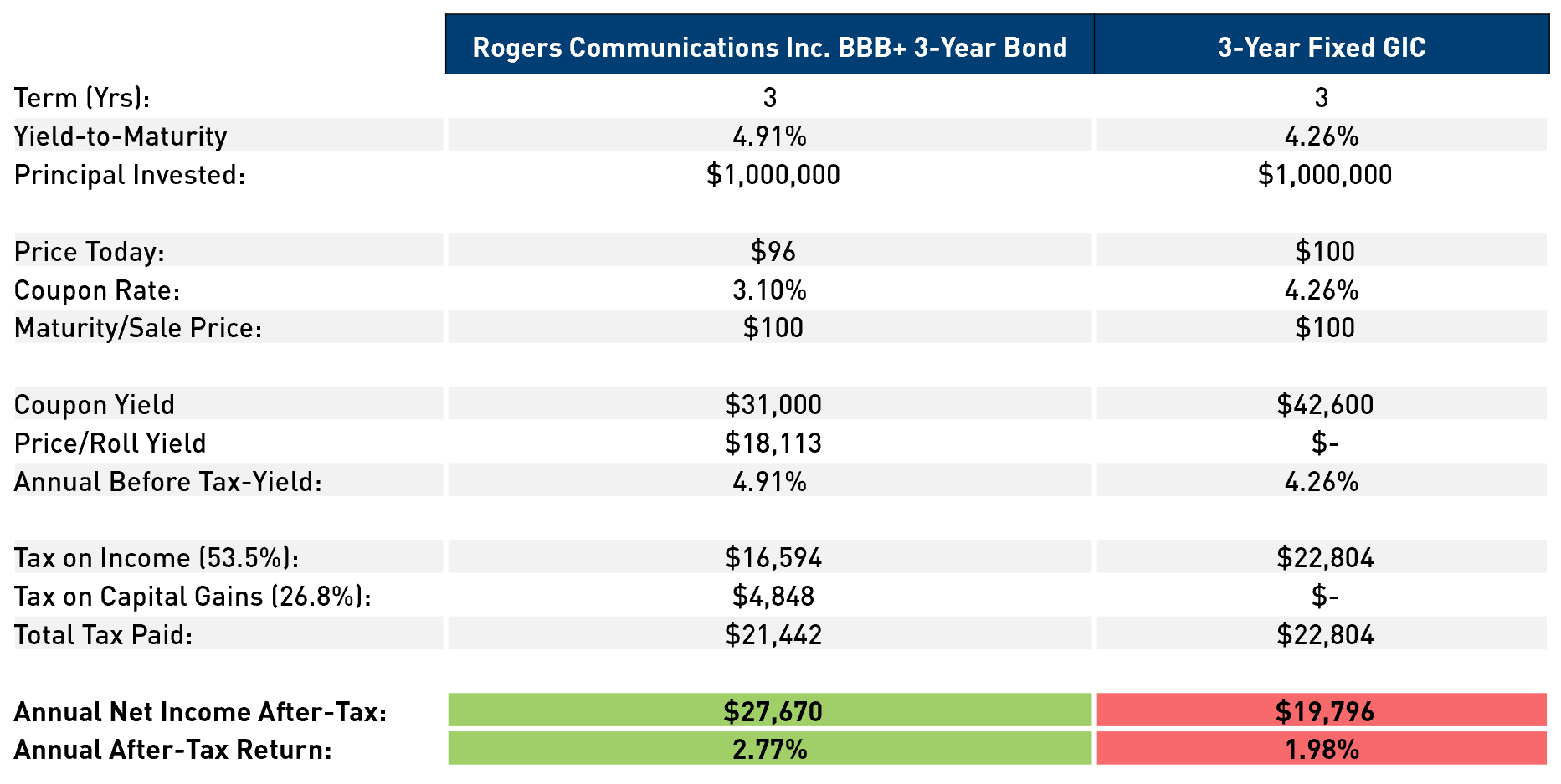

To illustrate, we have provided an example of a 3-year GIC vs. a 3-year corporate bond trading at a $4 discount to its original Par value.

Source: Bloomberg, RBC Dominion Securities. Data as of September 7th, 2022.

3-Year GIC coupon rate is based on GIC rates compiled by RBC Dominion Securities Inc. as of September 7th, 2022.

The yield to maturity for this specific bond is 4.9% split as ~3.1% per year from coupon payments and the remaining 1.8% from an upward move in the bond price as it gets closer to its maturity date and repayment of principal.

The yield that an investor collects from the non-coupon related increase in the bond price is taxed beneficially as a capital gain and ultimately leads to a better after-tax return for a taxable investor relative to holding a GIC with a similar yield.

Bonds Provide Liquidity at a Reasonable Cost

Bonds are liquid, publicly traded instruments that are generally traded over the counter (OTC) through dealers. Transaction costs are not standardized like they are for equities that trade on an exchange. Instead, transaction costs are embedded into the dealer's bid-offer spread and typically have a minimal impact on liquid investment grade bond prices.

Non-cashable/non-redeemable GICs are almost always required to be held until maturity. To break a contract early, you would have to demonstrate significant financial hardship, and even then, there is no guarantee that an issuing financial institution would let you redeem. If the issuer does agree to break the contract, there are usually substantial penalties which often include the loss of some or all of your accrued interest.

For clients who prefer higher liquidity, a daily traded mutual fund or monthly redeemable investment fund might be a more agreeable way to pursue higher yields and returns. Particularly if the allocation has a longer strategic role in a broader portfolio setting that has been tuned to achieve pre-defined financial goals.

Putting it All Together

For decades, bonds have been a resilient and consistent asset class that has provided investors with sought-after stability. Although the recent volatility has been unfortunate, it has given bonds the ability to once again offer longer-term protection and a return profile that is now more likely to keep pace with inflation over the next few years.

We believe this is a critical period for investors to move closer to a neutral weight in bonds as the higher forward yields and capital appreciation opportunities can now compensate investors over the intermediate and longer term. Simple logic would dictate that the time to buy bonds is when inflation measures are above average considering higher yields are available as compensation for that risk, particularly when you have a long investment horizon and the chance of inflation being lower in the next few years is more likely.

Important Information

The information presented herein is for informational purposes only. It does not provide financial, legal, accounting, tax, investment, or other advice and should not be acted or relied upon in that regard without seeking the appropriate professional advice. The information is drawn from sources believed to be reliable, but the accuracy or completeness of the information is not guaranteed, nor in providing it does RP Investment Advisors LP (“RPIA”) assume any responsibility or liability whatsoever. The information provided may be subject to change and RPIA does not undertake any obligation to communicate revisions or updates to the information presented. Unless otherwise stated, the source for all information is RPIA. This document does not form the basis of any offer or solicitation for the purchase or sale of securities. Products and services of RPIA are only available in jurisdictions where they may be lawfully offered and to investors who qualify under applicable regulation.

Unlike GICs, RPIA-managed funds or strategies are not guaranteed and carry the risk of financial loss. “Forward-Looking” statements are based on assumptions made by RPIA regarding its opinion and investment strategies in certain market conditions and are subject to a number of mitigating factors. Economic and market conditions may change, which may materially impact actual future events and as a result RPIA’s views, the success of RPIA’s intended strategies as well as its actual course of conduct.