Key Takeaways

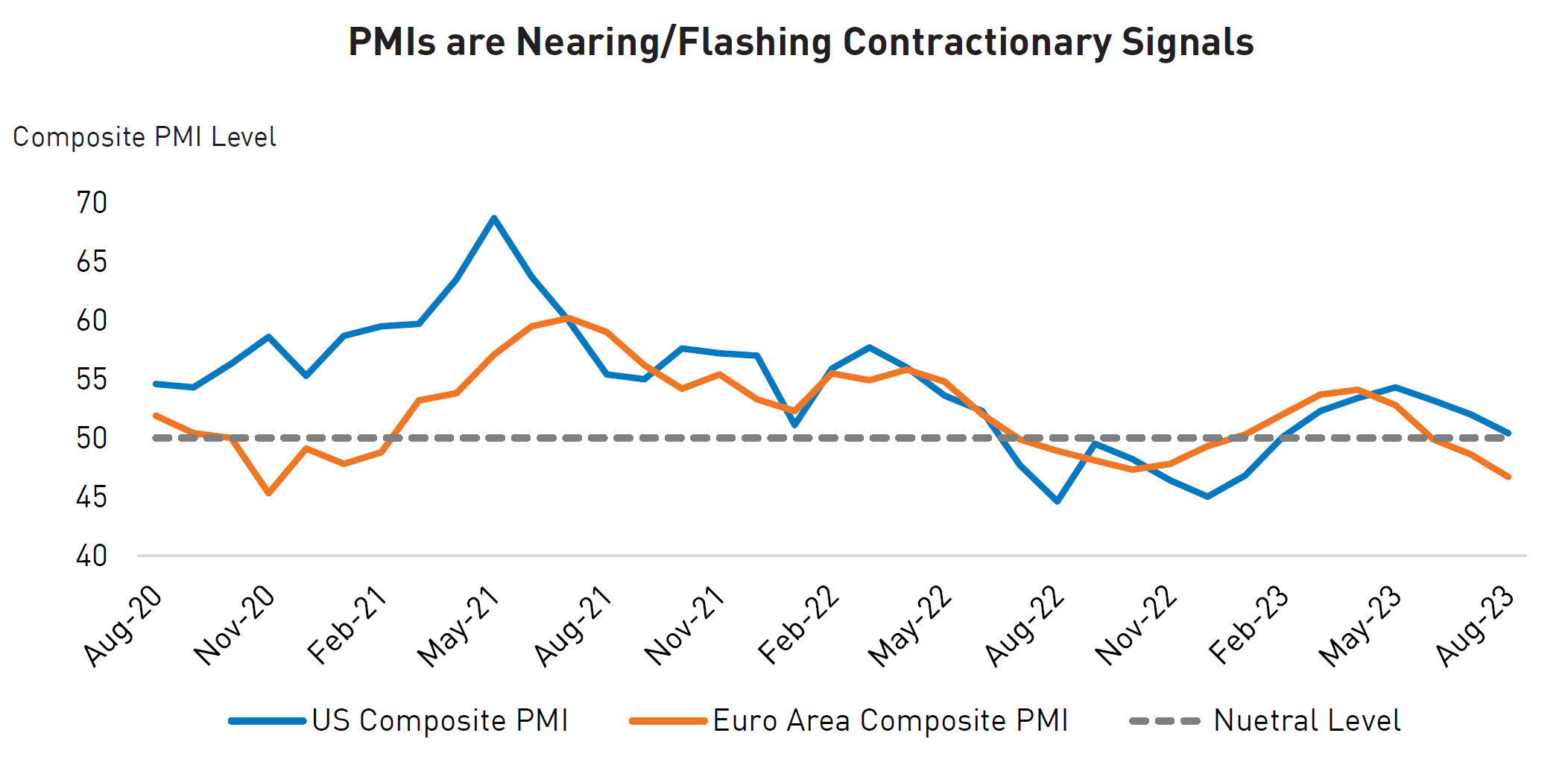

- Central bank policy is clearly having an effect on economic activity and growth, with some indicators showing cumulative slowdowns and others showing more sudden changes.

- In addition to idiosyncratic events, such as the regional bank crisis in March 2023, these policies are creating increased dispersion and dislocation in credit markets.

- This dynamic has allowed our strategies to acquire bonds, particularly high-conviction non-bank financials, at an attractive discount to fair value and realize profits via tactical active management.

Macroeconomic Backdrop

Central bank policy has remained restrictive throughout 2023 with policymakers indicating rates will remain “higher for longer.” The effects of this monetary policy are evident in both the U.S. and Canada, impacting job growth, wages, manufacturing activity, and overall GDP.

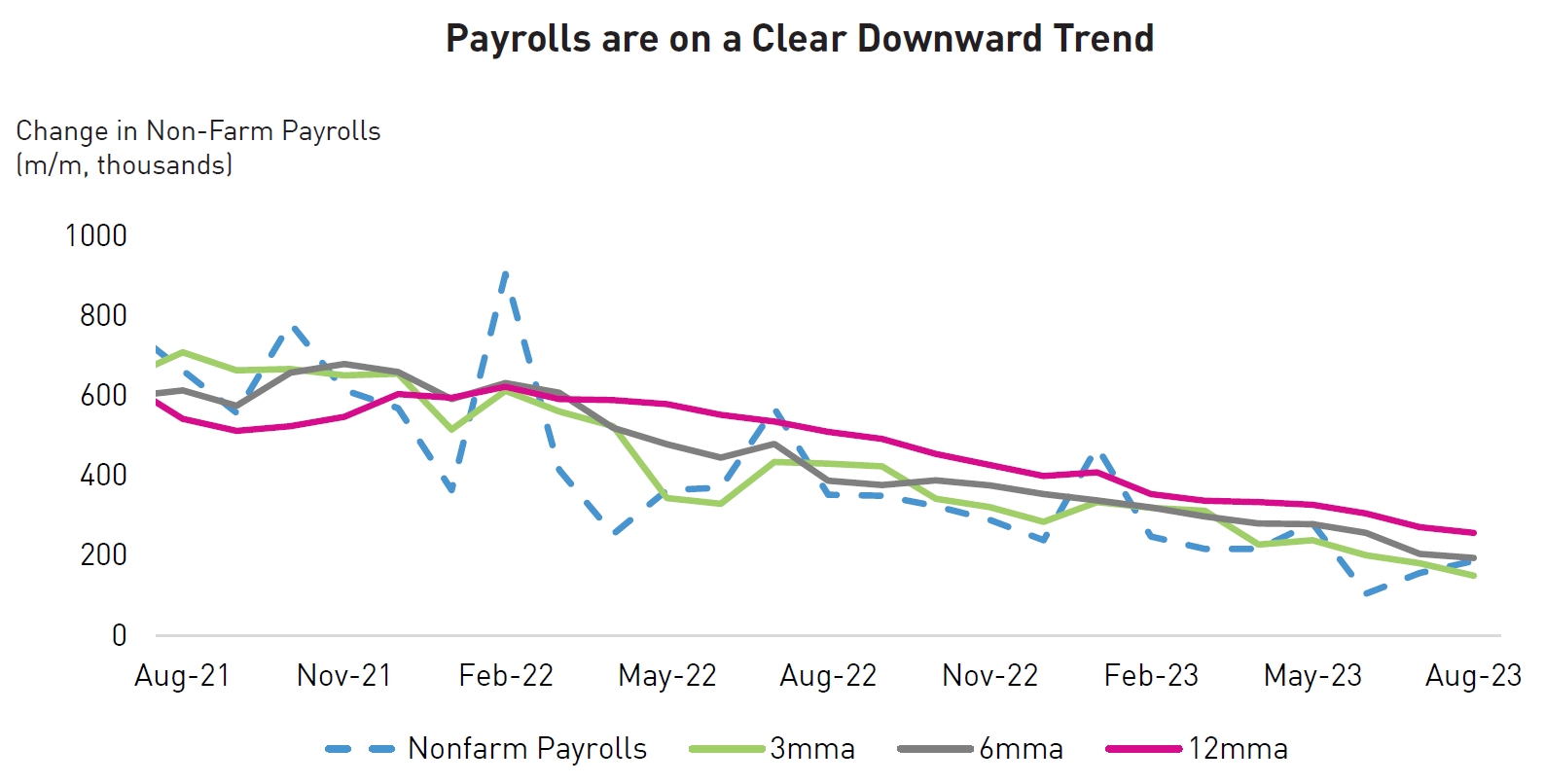

Although there have been month-to-month spikes, payrolls have exhibited a clear trend lower over the past 18 months while wage growth is moderating.

Source: Bureau of Labor Statistics, Federal Reserve Bank of Atlanta. Data as of August 31, 2023. MMA = month moving average.

Source: Bureau of Labor Statistics, Federal Reserve Bank of Atlanta. Data as of August 31, 2023. MMA = month moving average.

Additionally, consumer confidence in Canada has trended sharply downwards since the post-COVID peaks seen in 2021, and now sits at levels not seen since the early depths of COVID and the 2008 Great Financial Crisis.

Source: Bloomberg, S&P Global, The Conference Board of Canada. Data as of August 31, 2023.

We believe a softening in the indicators above is an important milestone that may provide central banks some comfort to end their hiking cycles.

What This Means for Credit Markets

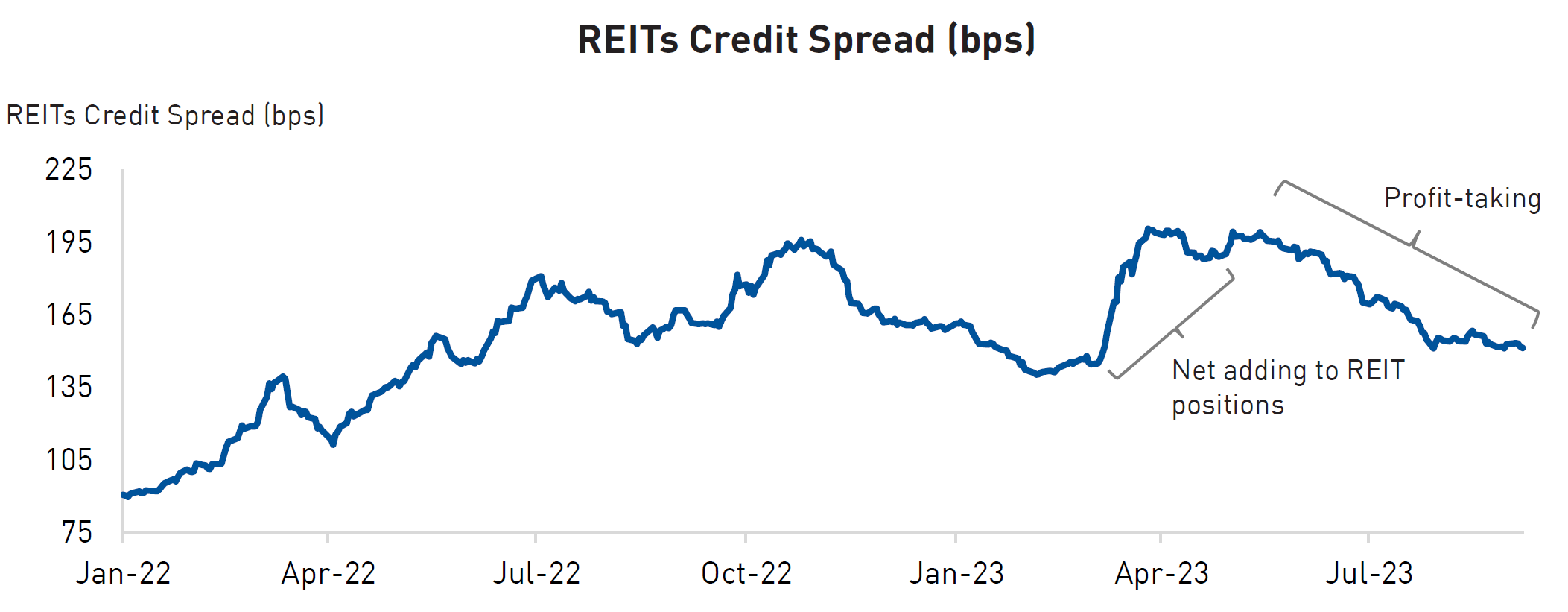

With several key indicators showing softness – some abruptly so – and messaging from the Federal Reserve that rates will remain “higher for longer,” we are finding increasing dispersion in pockets of the credit markets as they reprice for this new environment.

Over the past couple months, we have taken several actions within our portfolios to capitalize on this dynamic within the non-bank financial sector.

Example 1: Real Estate Investment Trusts ("REITs")

Following the regional bank scare in March 2023, investors indiscriminately sold REIT bonds on broad concerns over those companies’ liquidity positions and financing conditions in the space, making the sector one of the most battered in credit markets.

Amid this backdrop, we took advantage of the market “throwing the baby out with the bathwater” by finding attractive opportunities in companies that:

- Own the highest quality real estate in their segments/geographies, whether in healthcare, entertainment, gaming, office, or retail,

- Are armed with ample liquidity and sources of financing to ride out a recession with stable tenants locked into paying rent for several years into the future, and

- Are on deleveraging paths with clear catalysts, such as asset sales, to improve their credit profile.

In addition, we have focused on bonds that have strong downside protection, either through structural features (i.e., coupon steps, where we are paid additional interest in the event of a downgrade) or low purchase prices. By design, many of our REIT investments have been made well below par (i.e., $65-$80 per $100 bond), insulating us from potential loss. For example, by paying 70 cents on the dollar for bonds of a company whose capital structure is 50% debt, we are essentially protecting ourselves against up to a 65% decline in the value of the underlying properties.

Despite the sector’s strong performance in Q2 and into Q3, we believe opportunities remain attractive as intra-sector dispersion remains high. Furthermore, several high-quality REITs have near-term bond maturities, which have given us (and will continue to give) the opportunity to provide liquidity at all-in yields well in excess of the risk we are taking.

Source: Bloomberg. Data as of September 8, 2023. REIT Credit Spread = Bloomberg US Invesment Grade: REITs OAS (I00689 Index)

Source: Bloomberg. Data as of September 8, 2023. REIT Credit Spread = Bloomberg US Invesment Grade: REITs OAS (I00689 Index)

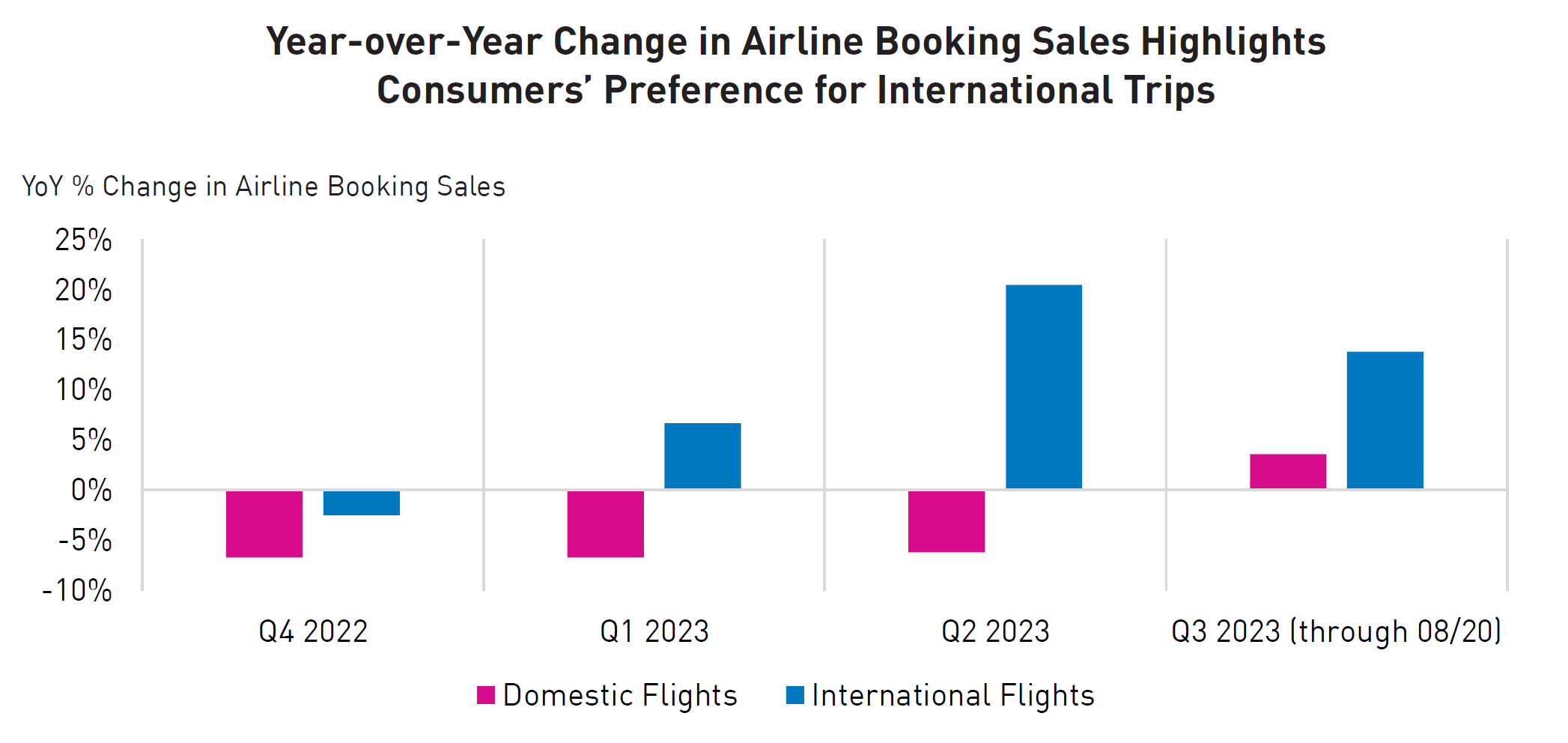

Example 2: Airlines

Consumer spending has thus far remained robust but is focused on “experiences” such as travel rather than durable goods, driving airfares to record high levels. Much of this has been funded by consumers drawing upon their pandemic savings.

Our view has been that this level of spending and record-high fares would not be sustainable, given data indicating those savings are almost exhausted. This view is further supported by the mounting burden facing consumers due to the cumulative effects of inflation and the restart of student loan repayments on September 1st.

We used a highly tactical approach to take advantage of the pent-up demand and profit from this sector throughout 2022. In 2023, we have taken a more targeted approach to find issuers with:

- International-focused airlines that can capitalize on transpacific traffic recovery and pent-up demand in those regions, as opposed to U.S. domestic-only airlines

- Higher quality senior capital structure bonds with short maturities, which still offer highly attractive yields despite the high cash balances being held by U.S. airlines coming out of COVID

Our thesis on international travel outpacing domestic travel has driven outperformance in our airline holdings. In addition, several secured bonds we owned or increased our holdings of were subsequently upgraded to investment grade from high yield, further increasing our returns.

Source: Bank of America, RPIA. Data as of August 20, 2023.

Source: Bank of America, RPIA. Data as of August 20, 2023.

Example 3: Aircraft Lessors

Much like we saw with the REIT sector, aircraft lessors were among the most punished sectors in March 2023, given their status as quasi-financials.

However, we have identified strong tailwinds in this sector that we believe position lessors favourably as a shortage of new aircraft continues to drive high demand in aviation assets for lessors. This has resulted in higher lease rates across current/new technology aircraft and engines.

Persistent supply constraints also support an active trading market, benefiting the value of lessors' current fleet, including strong sale-and-lease-back activities as airlines deleverage and increase the market share of leased vs. owned aircraft.

Final Thoughts

The overall resilience in the credit markets year-to-date is masking the increased dispersion we are uncovering between sectors and between issuers within a given industry. This dispersion is being exacerbated by the cumulative toll of restrictive policy measures undertaken by global central banks.

While passive strategies rely on a rising tide to lift all boats, active managers aim to generate superior performance even in a more challenged environment. We are ready to embrace an increase in volatility in the coming quarters and are ensuring we do our fundamental work ahead of time so that we can pick credits – on both the long and short side – to generate superior performance.

Important Information

The information herein is presented by RP Investment Advisors LP (“RPIA”) and is for informational purposes only. It does not provide financial, legal, accounting, tax, investment, or other advice and should not be acted or relied upon in that regard without seeking the appropriate professional advice.

The information is drawn from sources believed to be reliable, but the accuracy or completeness of the information is not guaranteed, nor in providing it does RPIA assume any responsibility or liability whatsoever. The information provided may be subject to change and RPIA does not undertake any obligation to communicate revisions or updates to the information presented. Unless otherwise stated, the source for all information is RPIA.

The information presented does not form the basis of any offer or solicitation for the purchase or sale of securities. Products and services of RPIA are only available in jurisdictions where they may be lawfully offered and to investors who qualify under applicable regulation.

“Forward-Looking” statements are based on assumptions made by RPIA regarding its opinion and investment strategies in certain market conditions and are subject to a number of mitigating factors. Economic and market conditions may change, which may materially impact actual future events and as a result RPIA’s views, the success of RPIA’s intended strategies as well as its actual course of conduct.