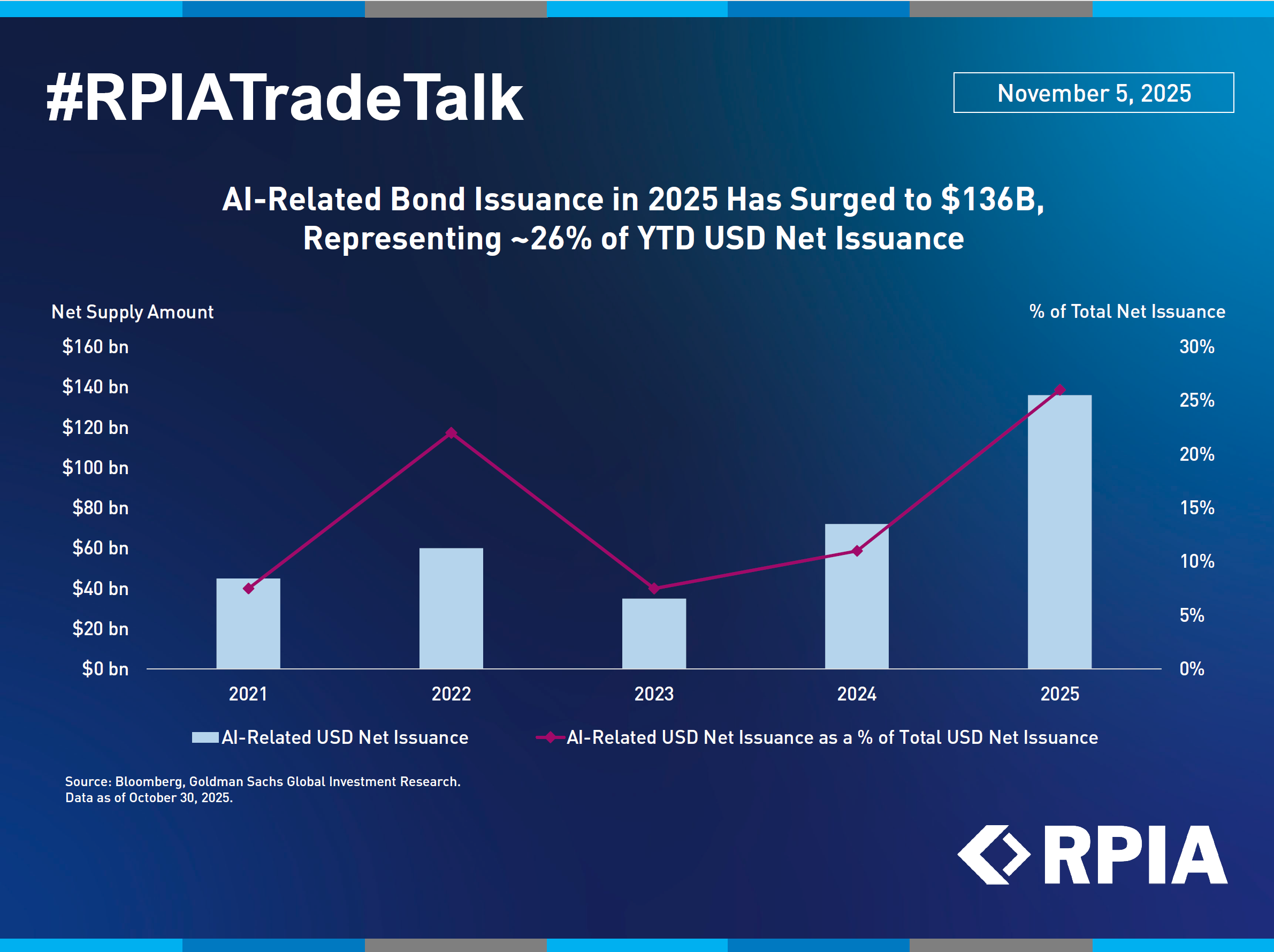

As the AI-driven rally continues, we are now seeing greater use of the bond market to fund hyperscaler buildouts. Meta’s recent $30bn deal brings USD AI-related net issuance to a record ~$136bn YTD (roughly 26% of total USD net supply). This supply surge has weighed on credit spreads, particularly across the Technology, Media, and Telecommunications sectors where AI-driven issuance is concentrated.

We are approaching these new issues selectively on a deal-by-deal basis. At the same time, we’re positioned to hedge potential drag in more vulnerable areas such as BBB-rated cable and telecom companies. We may seek to add exposure if we see a cooldown in public market issuance - either via a shift toward private credit funding or reduced forward capex guidance.