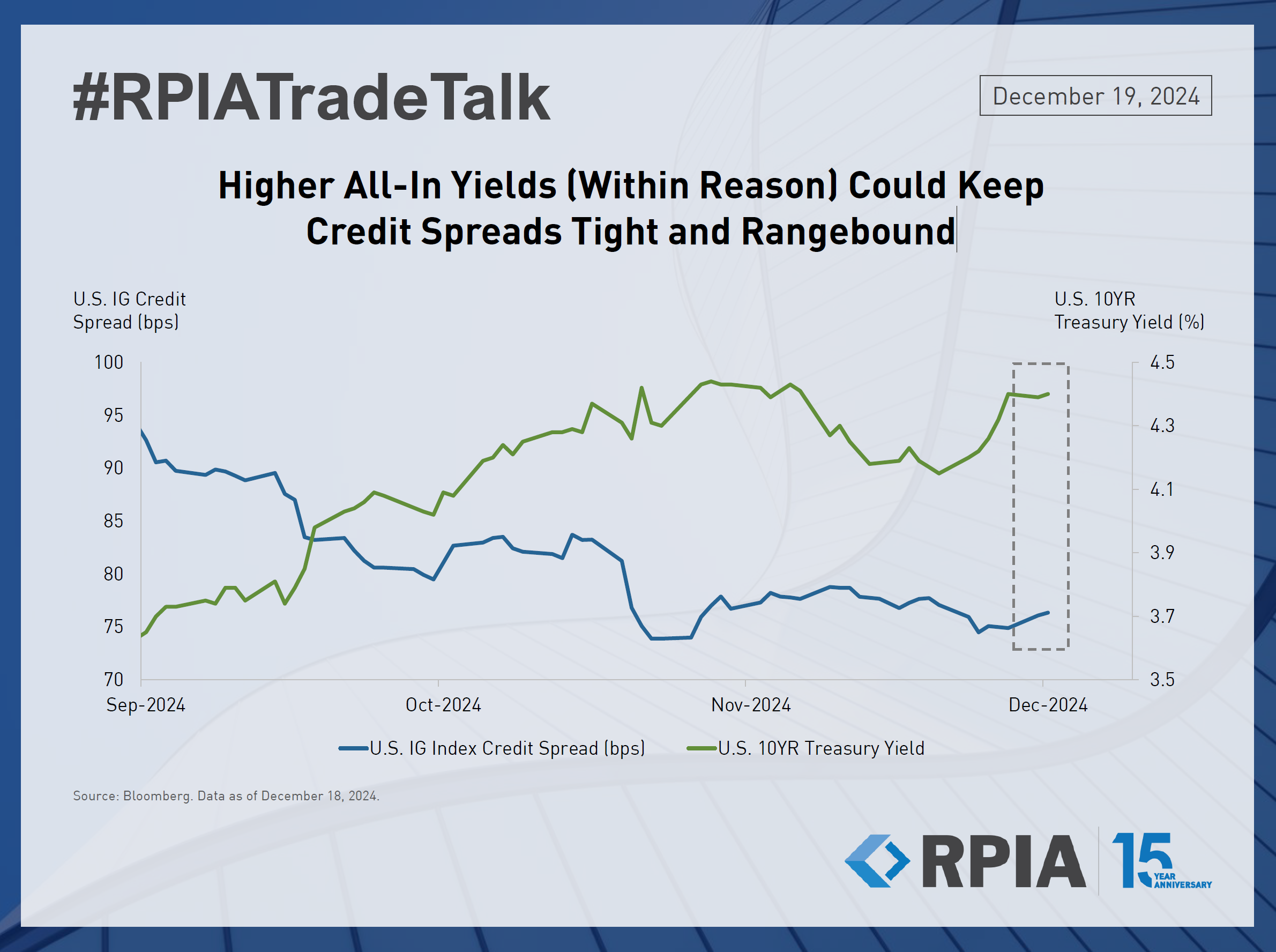

Strong credit spread performance has made valuations rich heading into year-end, leading to some index-level uncertainty around the likelihood of further returns from spread tightening. That said, tight spread levels have been supported by fundamental and technical factors that have put a ceiling on spread-widening events. For instance, the attractiveness of all-in corporate bond yields has fueled insatiable demand from yield-sensitive (i.e., pensions and insurance companies) and retail investors alike.

Given this interplay between all-in yield levels and demand, we believe the most notable risk to widening credit spreads is materially lower yields, which could occur if the economy deteriorates significantly and forces central banks to cut rates drastically. However, this outcome is not our base case, specifically in the U.S., where the economy remains resilient, and inflation remains persistent. As such, in 2025, we expect higher interest rates (within reason) to continue to act as a tailwind for credit spreads.