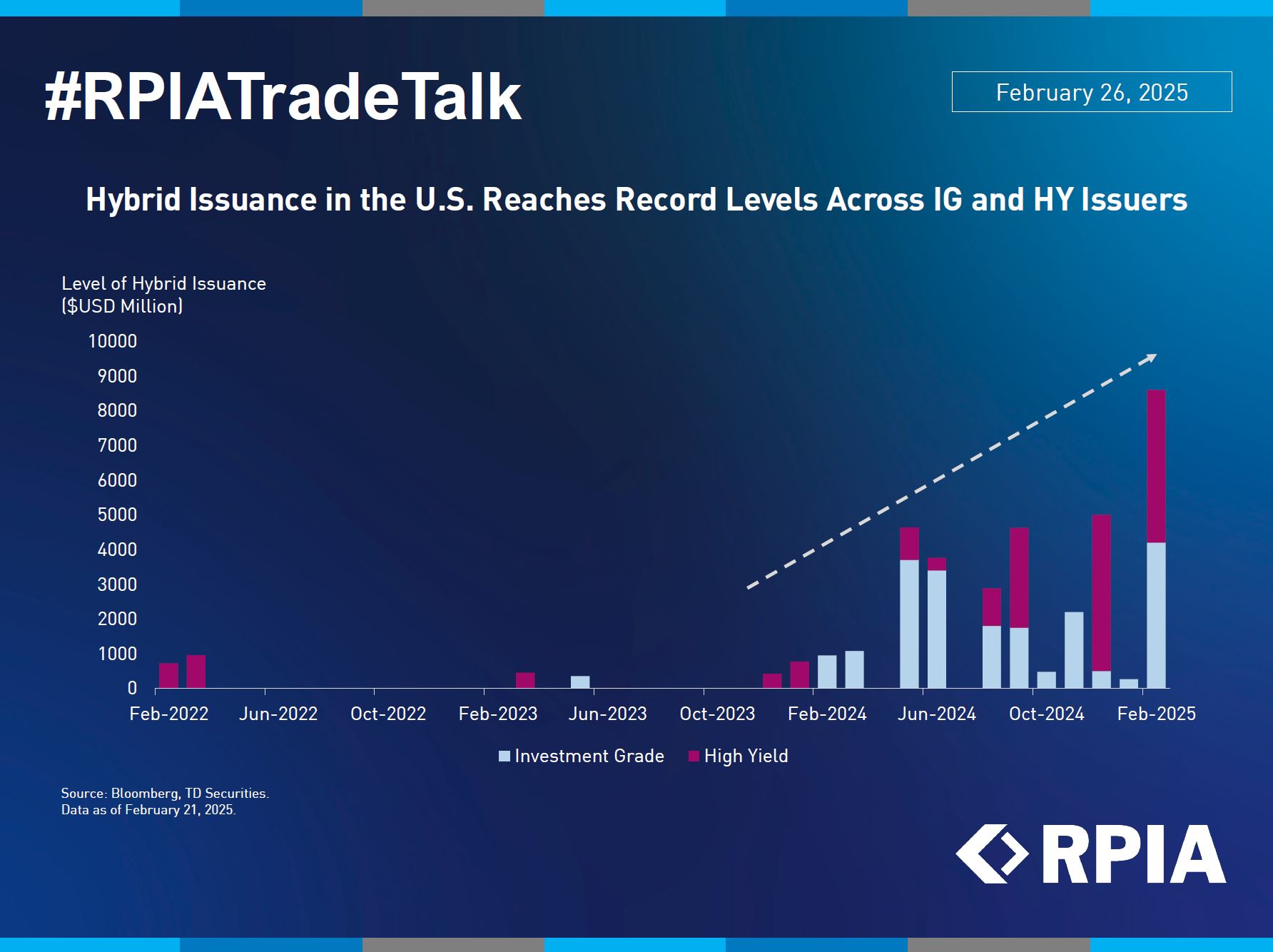

Interest in hybrid issuance has surged following Moody’s 2024 rating methodology update for subordinated hybrid securities, which grants greater equity credit to hybrids and lowers reported corporate leverage. To date, February has seen a record $8.6 billion in U.S. corporate hybrid issuance, significantly surpassing the previous high of ~$5 billion in December 2023. Prior to 2023, activity in this space was virtually nonexistent.

Given their lower position within the capital structure, hybrid securities typically offer an attractive yield premium over traditional debt, creating compelling opportunities to enhance yield from issuers where we have a strong fundamental conviction. Additionally, the evolving market dynamics present greater potential for relative value discrepancies across the capital structure. We have selectively participated in recent hybrid issuances and will continue to allocate tactically as attractive opportunities arise.