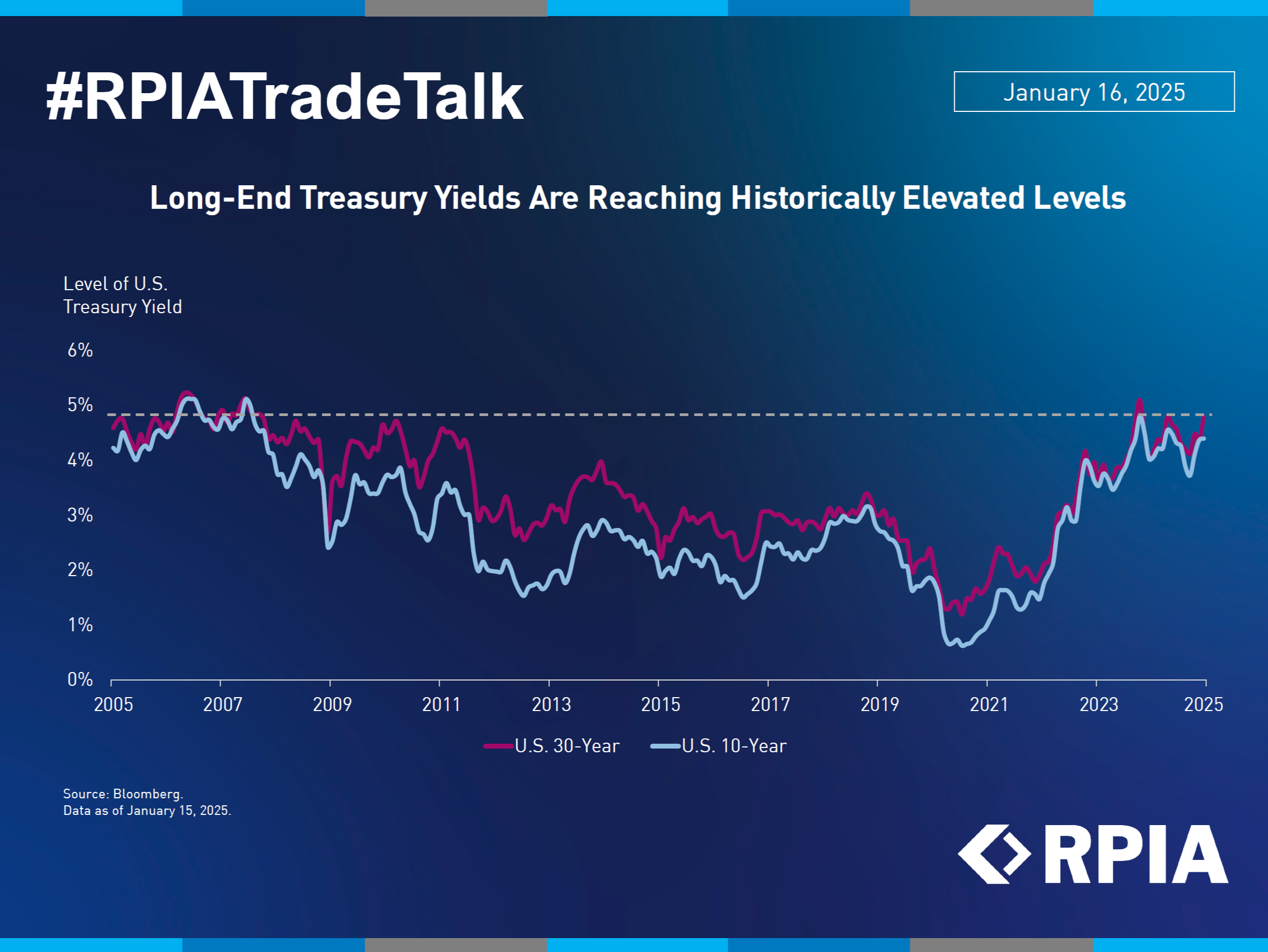

The term premium, which reflects the compensation investors demand for holding longer-dated government bonds, has been rising recently. Both 10-year and 30-year U.S. Treasury yields are at the highest levels in 18 years, driven by strong economic data, elevated inflation expectations, and policy uncertainties. This has steepened the yield curve as longer-term yields rise faster than short-term ones.

We expect term premiums to remain elevated due to large government deficits requiring financing, which could push longer-term yields even higher. In response, we are strategically managing our rate exposure by limiting longer-end rate risks while selectively increasing allocations to areas where long-term credit spread movements work in our favor.