The long-awaited Fed pivot finally arrived at Jackson Hole last Friday when Jerome Powell delivered an unmistakably dovish speech, which signaled that interest rate cuts are imminent. This announcement triggered a rally in interest rates and buoyed the returns of duration-heavy fixed income strategies.

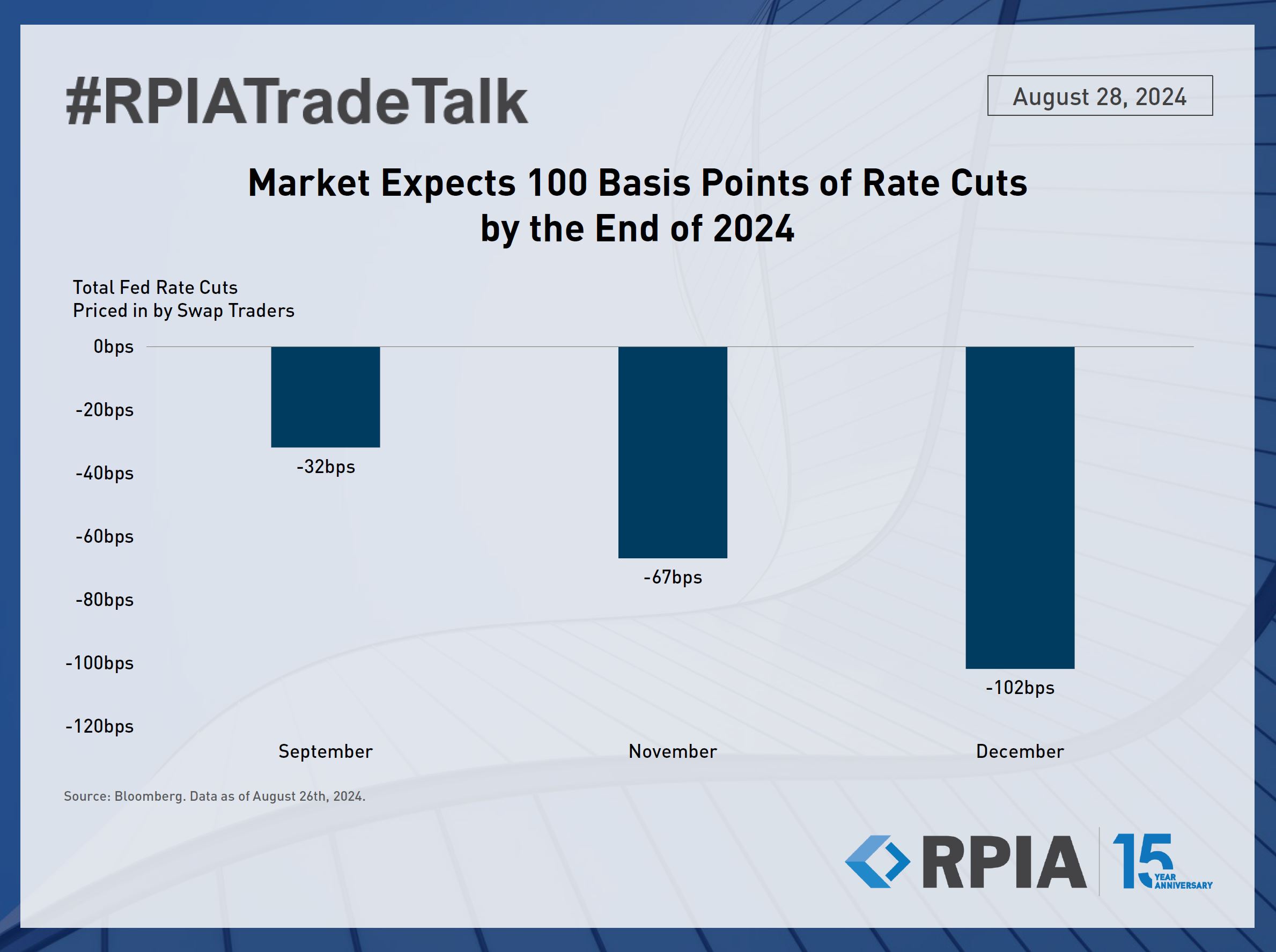

While the future path of interest rates may be clearer now, the reasoning, magnitude, and pace of the cuts remain uncertain. Currently, the market is pricing in roughly 100 basis points of cuts over the remaining three FOMC meetings in 2024. The updated dot plot at the upcoming September meeting will confirm if policymakers are aligned with the market.

We believe the most important factor for risk asset valuations is whether the ensuing rate-cutting cycle is intended to normalize monetary conditions or if it is meant to combat negative economic developments. Regardless, we stand ready to continue managing our portfolios’ risk exposures with a dynamic yet common-sense approach, depending on the data.