Back

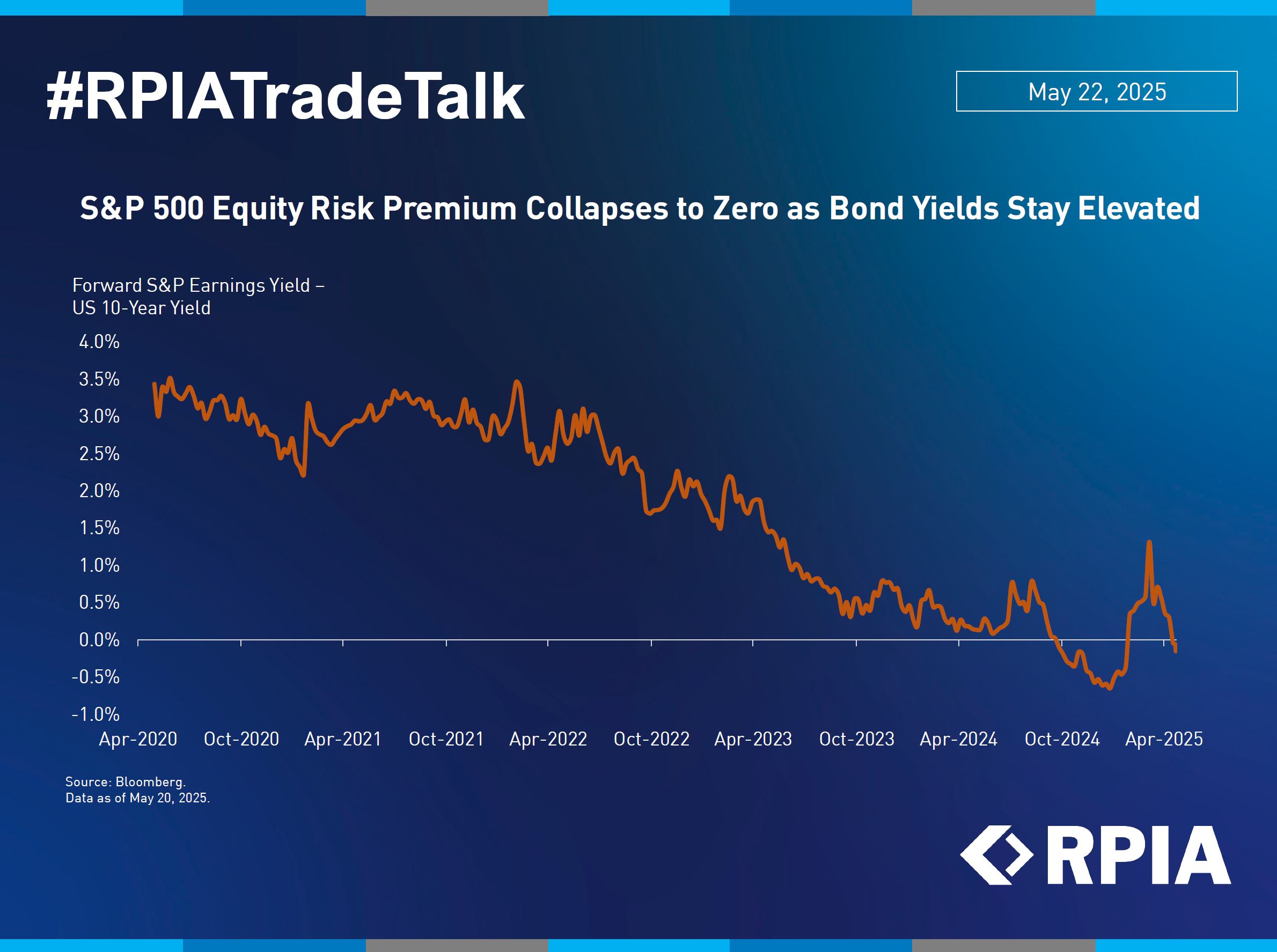

S&P 500 Equity Risk Premium Collapses to Zero as Bond Yields Stay Elevated

Markets staged a strong rebound over the last several weeks, driven by optimism around trade negotiations, lifting equities back into positive territory year-to-date despite lingering macro uncertainty and weak consumer sentiment.

However, the equity risk premium – a measure of the excess yield an investor earns by holding equities over bonds – tells a different story as it collapsed to zero. In other words, investors are no longer being compensated for taking equity risk.

This is because the earnings yield (how much you earn per share) of the S&P 500 dropped meaningfully from a high of 5.3% in April to just 4.4% today. Meanwhile, the 10-year US Treasury yield spiked over 4.6% due to stronger economic data, higher inflation expectations, and concerns over the fiscal deficit. Given this dynamic, we believe fixed income now offers a more balanced risk/reward profile relative to equities.