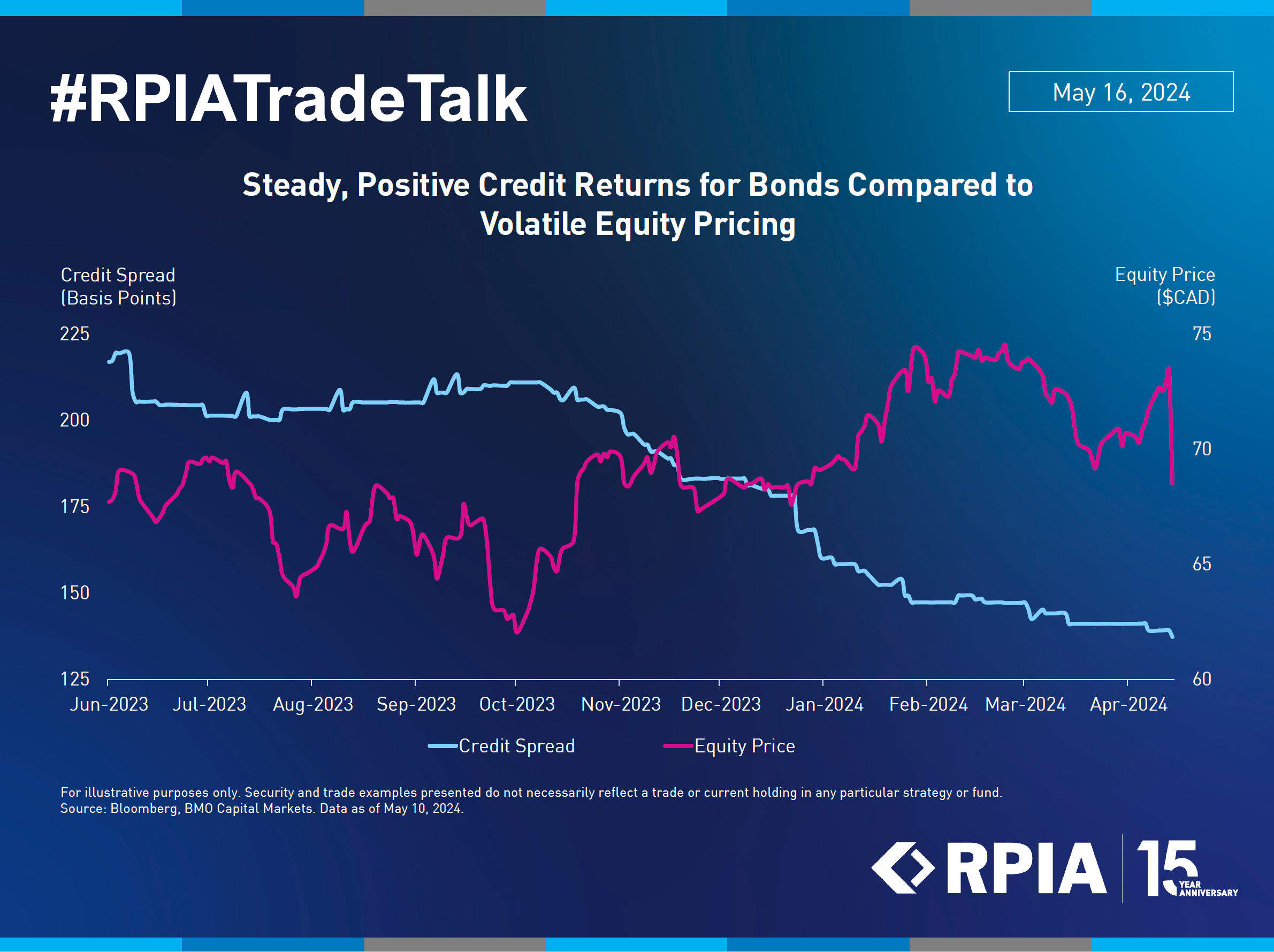

The robust demand for high-quality investment-grade bonds combined with a favorable technical backdrop has created an environment where many bonds are able to produce steady, positive credit returns compared to the same company’s equity shares.

As an illustration, we have plotted the equity price of a large Canadian financial firm compared to its bond’s credit spread level. The spread has consistently tightened since November 2023, which is a good thing for its bond price. Meanwhile, its equity pricing has shown a more erratic path, reflecting the ever-changing economic picture, inflation uncertainties, and the sector/industry outlook.

Despite longer term uncertainty, we believe strong market demand for higher yield

bonds and this company’s ability to consistently improve its creditworthiness

and financial health, has created an excellent opportunity for bond

investors.