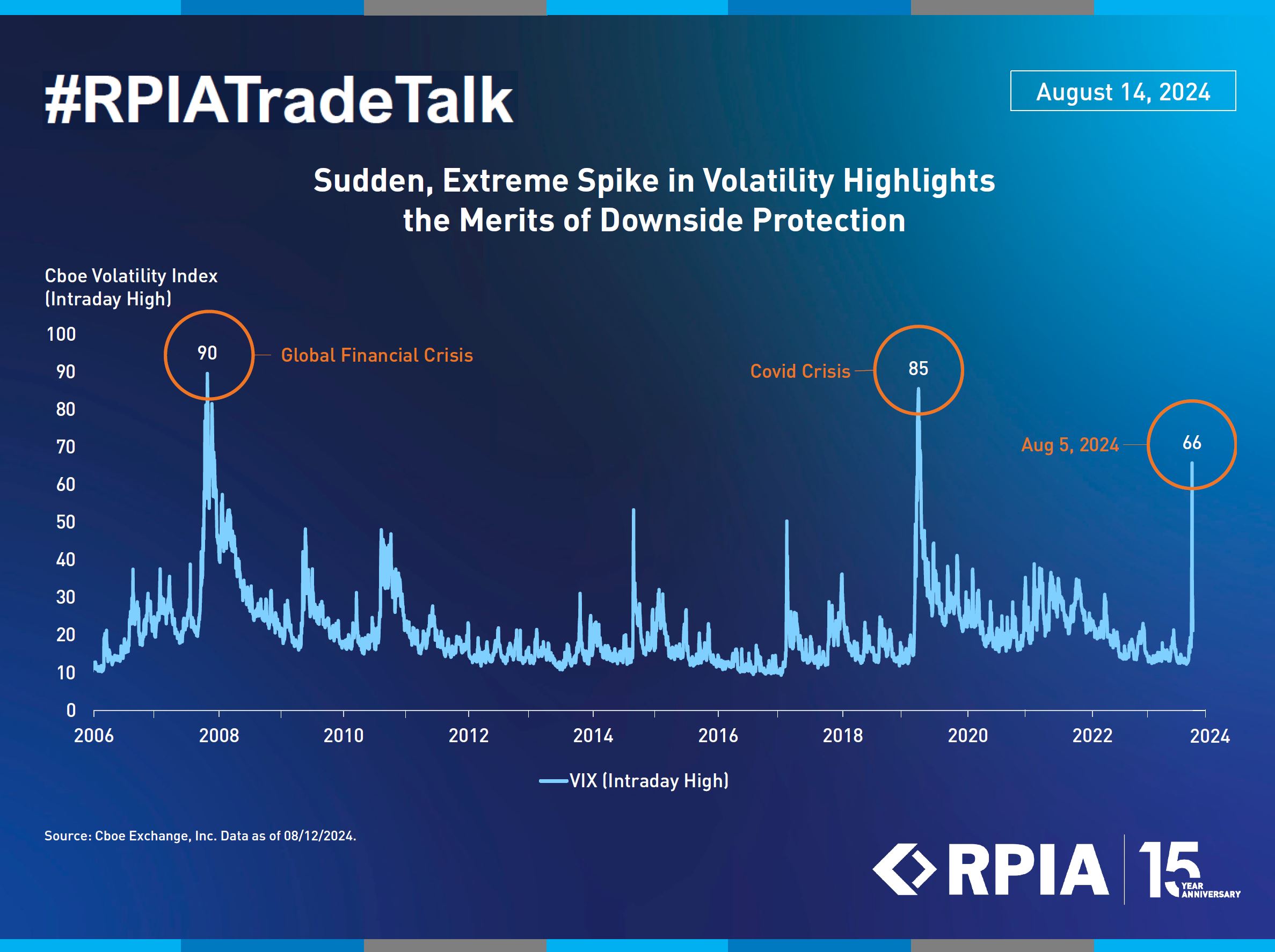

A perfect storm of macro and technical developments briefly destabilized financial markets during the first week of August. On August 5th, the VIX, a well-followed gauge of volatility, reflected the panic by spiking to an intraday high of 66. Levels this extreme have not been seen outside of the Covid Crisis and the Global Financial Crisis.

Prior to this recent spike, the broadly optimistic sentiment of a soft landing occurring and attractive yields (carry) on high-quality bonds made the cost of downside protection generationally cheap. We navigated this environment by giving up modest amounts of yield premium most of this year to embed substantial hedges, which paid off during the recent selloff.

More specifically, our call options on the VIX helped offset the majority of mark-to-market losses attributable to credit spread widening. Although markets have calmed since many segments we follow have not fully recovered. Fortunately, our hedges are empowering the investment team to remain invested, capitalize on dislocations, and uncover opportunities.