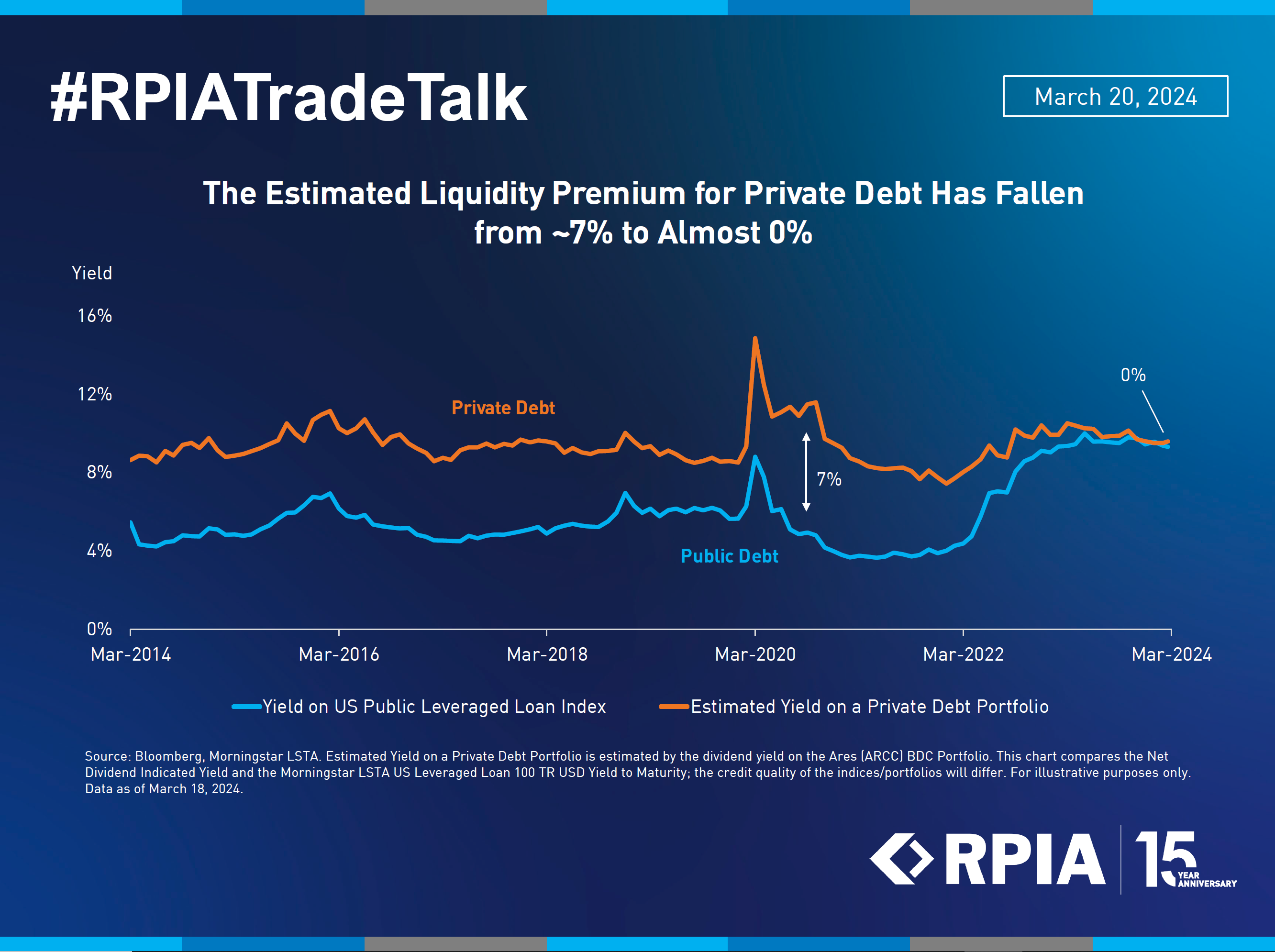

Following the Global Financial Crisis, looser monetary policy reduced the compensation offered by traditional financial securities like public equities and bonds, incentivizing investors to hunt for yield. As a result, money poured into private asset classes, including private equity and debt, which offered investors more attractive yields despite less liquidity (i.e., the ease of withdrawing invested capital). When investors sacrifice liquidity by investing in private assets, they are typically compensated with a greater return potential, which is also known as a "liquidity premium."

The recent transition away from the ultra-low interest rate environment has compressed this liquidity premium to nearly nothing. The chart above illustrates how this yield premium is negligible today compared to historical "norms," and investors can achieve comparable returns by investing in more liquid and much safer asset classes. We believe actively managed public credit can help navigate this phenomenon by striking the right balance between earning a reasonable return without sacrificing liquidity or adding undue complexity.