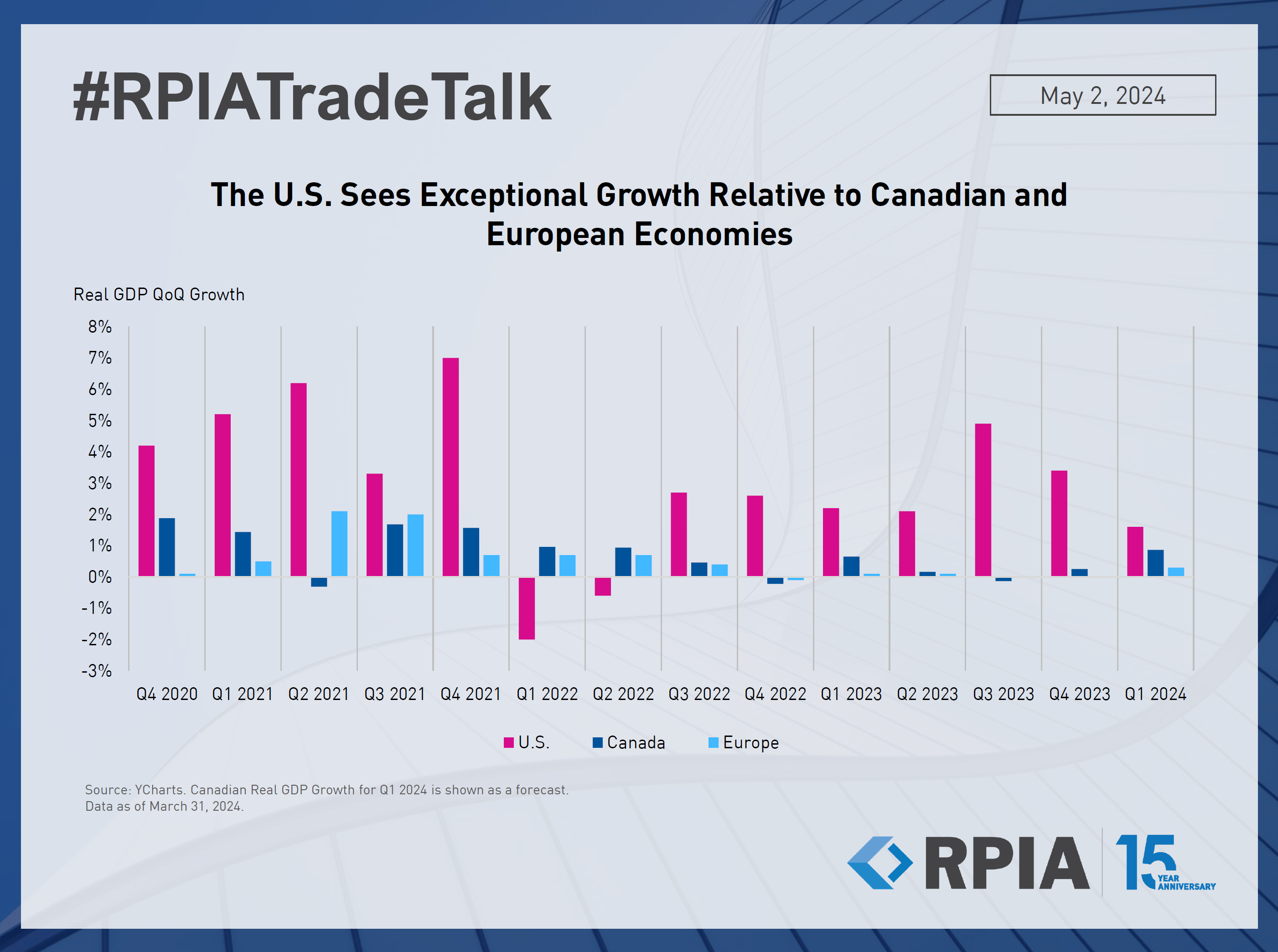

U.S. economic growth has declined year-to-date but continues to be strong relative to its Canadian and European counterparts. U.S. exceptionalism is being supported by positive economic data in job gains, manufacturing, and personal spending. This dynamic has put the brakes on widely accepted calls of a recession and, in turn, has led to a surge in bond yields as rate expectations for 2024 settle on a "higher for longer" scenario.

The economic resilience in the U.S. also gives us comfort regarding the corporate fundamentals of the issuers we are holding. Backed by a strong technical picture, we believe credit spreads stay range-bound, while providing us with opportunities to take advantage of the relative value differences between U.S., Canadian, and European bonds.