Back

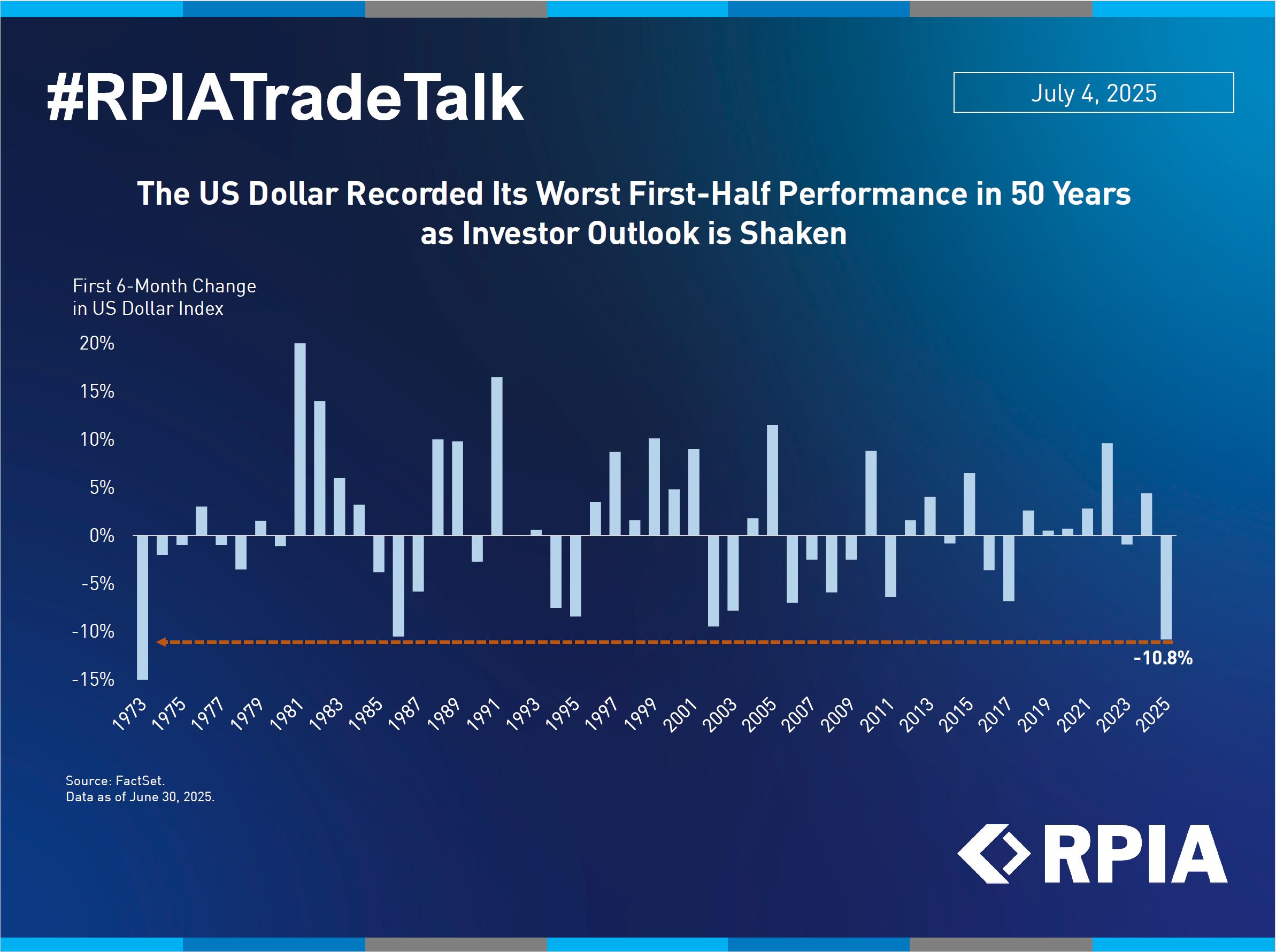

The US Dollar Recorded Its Worst First-Half Performance in 50 Years

as Investor Outlook is Shaken

The US dollar recorded its worst first-half performance since 1973. The Dollar Index, which measures USD strength against a basket of six other currencies including the pound, euro, and yen, has fallen 10.8% year-to-date. A combination of aggressive US fiscal policies - including the "big beautiful" tax bill, tariffs on imports from allied nations, and a deteriorating US growth outlook - has led investors to question the resilience of the dollar’s traditional “safe-haven” status.

While we do not believe the dollar’s safe-haven role is fundamentally at risk, we expect elevated dollar volatility to persist over the coming months, which could create additional challenges for fixed income investors with unhedged currency risk. For context, the CAD-hedged version of the Bloomberg US Corporate Bond Index has returned 3.3% YTD. However, if left unhedged, the index would have returned a loss of -1.2%. In this environment, we believe that having a rigorous and effective currency hedging program is not just optional, but essential to protecting investor capital.