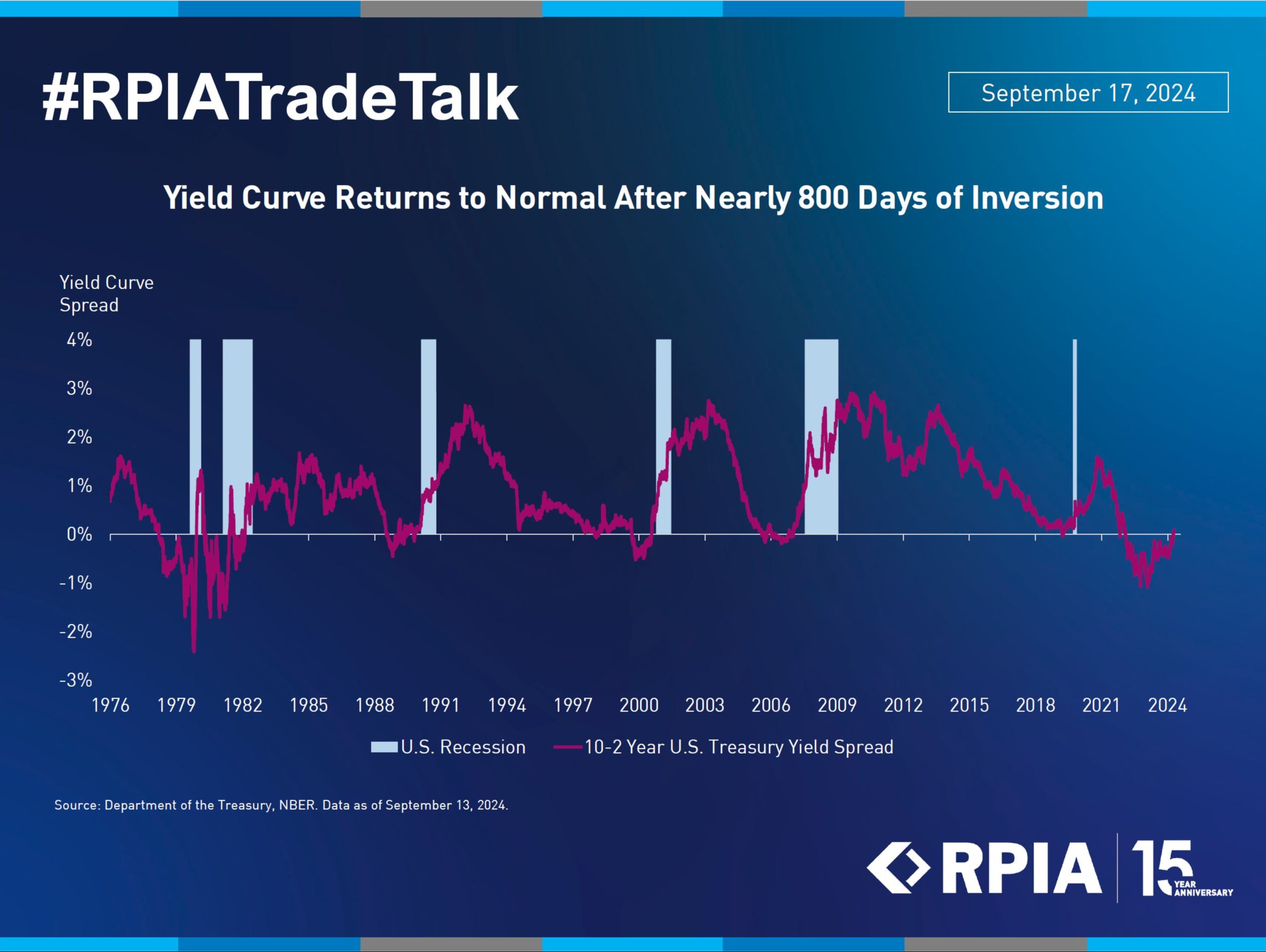

Until recently, the spread between 10-year and 2-year Treasury notes was inverted for nearly 800 days, marking the longest yield curve inversion in U.S. history. A yield curve dis-inversion has historically been seen as a recession harbinger, occurring around the onset of a downturn as short-term rates fall precipitously and policymakers cut rates to support the economy.

This is relevant today because the yield curve has just dis-inverted and returned to its normal, upward-sloping shape, but a recession does not seem imminent. We admit valuations are rich, but fundamentals continue to support them at this point in the cycle, and short-term rates have decreased in a relatively orderly manner. In response, we are gradually extending our positioning further out to 5-10 years to lock in more attractive yields while remaining cautious of the long end (15+ years) due to potential interest rate risks associated with the upcoming U.S. election results.