Market Commentary

Easing inflation and a normalizing labour market during the third quarter triggered rate cuts across global central banks. Most notably, the US Federal Reserve (“the Fed”) lowered rates in September for the first time since 2020. However, more recently, enthusiasm for a Goldilocks soft landing has gained steam, especially after the latest blowout US jobs report reinforced the resilience of the US economy. This data has led to more tame monetary easing expectations, with markets now projecting ~2 rate cuts for the remainder of 2024 from the Fed and the Bank of Canada.

With the US presidential election only about a month away, we expect market focus will soon shift, likely reducing risk as we get closer to election day. Additionally, markets have been surprisingly nonchalant about ongoing geopolitical unrest in the Middle East and Ukraine, choosing rather to focus on Fed-driven optimism. In our view, the likelihood of escalation is too uncertain to ignore, and we look to embed modest additional downside protection.

Overall, fixed income continues to be in vogue as we head into the end of the year, and we expect another strong quarter for fixed income, supported by an eager and diverse buyer base. While valuations may dampen, we continue to see individual opportunities within credit where we can tactically add value. We are generally moving up in credit quality and exploring opportunities to add downside protection amid the likelihood of continued volatility. While the market seems enthusiastically optimistic, our team continues to be cautiously optimistic, mindful that a number of risks could evolve over the next quarter but attuned to compelling opportunities that may spring up in this environment.

RP Fixed Income Plus

| 1 MON | 3 MON | 6 MON | YTD | 1 YR | 3 YR | 5 YR | 10 YR | Since Inception | |

|---|---|---|---|---|---|---|---|---|---|

| RP Fixed Income Plus | 1.17% | 3.33% | 4.46% | 4.79% | 9.00% | 3.16% | 2.52% | 2.54% | 3.63% |

| FTSE Canada Universe Short-Term Bond Index | 1.31% | 3.39% | 4.68% | 5.02% | 9.33% | 1.74% | 2.02% | 1.96% | 2.23% |

| Added Value | -0.14% | -0.07% | -0.22% | -0.22% | -0.33% | 1.42% | 0.50% | 0.58 | 1.41% |

Source: RPIA. FTSE Russell. Data as of 09/30/2024 and annualized for periods greater than one year. SI = 07/2010. RP Fixed Income Plus strategy performance presented above represents a weighted-average composite return of separately managed accounts utilizing a similar strategy from inception in July 2010 to April 2013 and linked to the returns of the RP Fixed Income Plus Fund, Series A thereafter.

FIP returned +3.33% during the quarter, performing in line with the FTSE Canada Universe Short-Term Bond Index (the “Index”).

The Strategy saw positive returns from credit spread exposure, while interest rate exposure drove the majority of returns as short-term rates rallied aggressively. Canadian government-related exposures were notable contributors to total returns. Credit returns were driven by energy infrastructure and financial-related issuers, including global/domestic systematically important banks and short-dated bonds of the financial services subsidiary of Ford Canada.

| Top Contributors to Credit Return (Sector) |

|---|

| Energy-Infrastructure |

| Financials |

| Industrials |

Source: RPIA. Data as of 09/30/2024.

| Top Contributors to Credit Return (Issuer) |

|---|

| Enbridge Inc. |

| Inter Pipeline Ltd/AB |

| Rogers Communications Inc. |

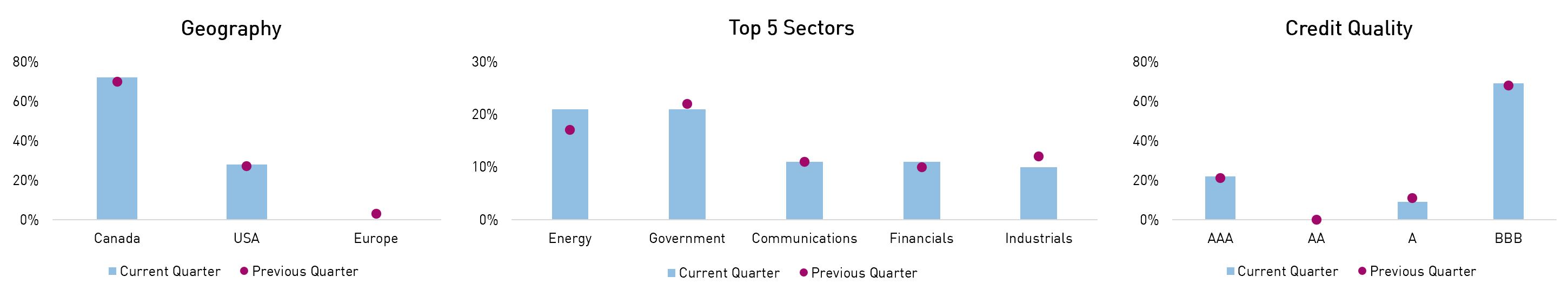

Headline portfolio metrics were relatively unchanged quarter-over-quarter, although interest rate exposure was modestly reduced alongside the interest rate rally. From a geographic perspective, the portfolio trimmed its already slim exposure to the European market to add to North American bonds. Sector-wise, profitable consumer-related holdings were monetized and reallocated to the energy and technology sectors. The portfolio’s credit quality breakdown was relatively unchanged during the quarter, maintaining a barbell between AAA-rated government and BBB-rated corporate bonds. We believe the Strategy continues to offer investors a high-quality value proposition, given its healthy yield of 4.1% – greater than the Index’s yield of 3.2% – and the short-dated nature of the portfolio.

| Q3 2024 | Q2 2024 | |

|---|---|---|

| Effective Duration (Years) | 2.5 | 2.6 |

| Credit Duration (Years) | 1.9 | 1.9 |

| Average Term (Years) | 2.8 | 3.0 |

| % Rated Investment Grade | 100% | 100% |

Source: RPIA. Data as of 09/30/2024.

Source: RPIA. Data as of 09/30/2024.

RP Strategic Income Plus Fund

| 1 MON | 3 MON | 6 MON | YTD | 1 YR | 3 YR | 5 YR | Since Inception | |

|---|---|---|---|---|---|---|---|---|

| RP Strategic Income Plus Fund (Class F) | 1.59% | 3.97% | 5.06% | 5.35% | 13.09% | 2.44% | 3.42% | 3.90% |

| FTSE Canada All Corporate Bond Index | 2.12% | 4.67% | 5.81% | 5.88% | 13.96% | 1.49% | 2.11% | 2.96% |

Source: RPIA, FTSE Russell. Data as of 09/30/2024 and annualized for periods greater than one year. SI = 04/2016.

STIP gained +3.97% during the quarter, a lower return than the FTSE Canada All Corporate Bond Index (the “Index”), which had a higher exposure to interest rates during the period.

Both credit spread and interest rate exposure contributed to total returns during the quarter as credit spreads and interest rates rallied. Credit returns were well-diversified across sectors, with domestic and French energy-infrastructure issuers leading the way. Positions in high-quality global/domestic systemically important banks and select specialty financial holdings with attractive relative value attributes also boosted returns. Domestic telecommunication companies continued to generate respectable returns, while opportunistic trades in US media issuers proved timely. The Fund’s recent increase in provincial and government-related exposures significantly contributed to total returns.

| Top Contributors to Credit Return (Sector) |

|---|

| Energy-Infrastructure |

Financials |

| Telecommunications/Media |

Source: RPIA. Data as of 09/30/2024.

| Top Contributors to Credit Return (Issuer) |

|---|

| Enbridge Inc. |

| Allied Properties Real Estate Investment Trust |

| Boeing Co/The |

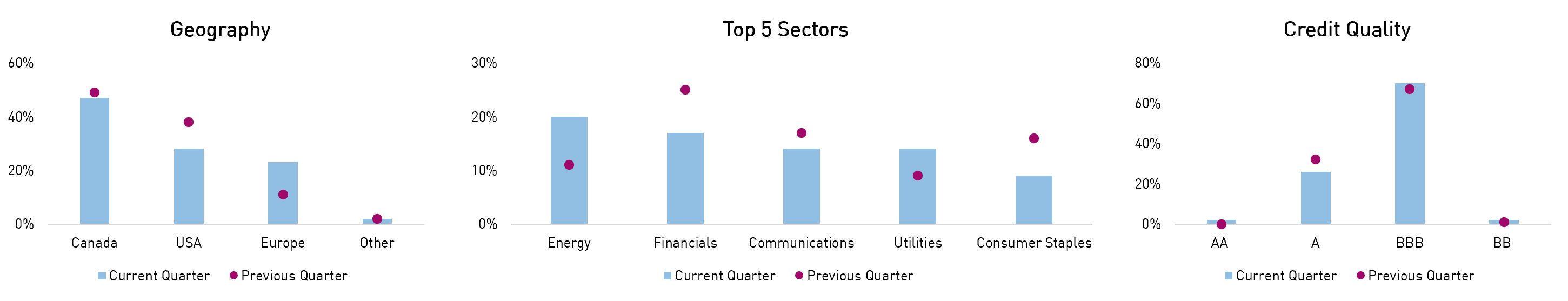

Headline risk exposure was steadily reduced during the period as credit spread and interest rate valuations grew less attractive at the index level. Geographically, the portfolio notably rotated out of US positions and into EUR-domiciled exposures, which continues to be concentrated on high-quality Yankee banks and corporate issuers with global operations. Sector-wise, the portfolio monetized financial, consumer staple, and industrial-related positions and added to energy-infrastructure issuers. Quality-wise, the portfolio finished the period with an A- rating and minimal (2%) high yield exposure, which primarily consists of a corporate hybrid security of a domestic telecom that is rated investment grade at the issuer level. We believe the Fund can continue to actively source positive returns from both interest rate and credit spread exposure, underpinned by an attractive technical environment for credit.

| Q3 2024 | Q2 2024 | |

|---|---|---|

| Effective Duration (Years) | 4.1 | 4.7 |

| Credit Duration (Years) | 4.0 | 5.4 |

| Average Term (Years) | 10.0 | 11.1 |

| % Rated Investment Grade | 98% | 99% |

Source: RPIA. Data as of 09/30/2024.

Source: RPIA. Data as of 09/30/2024.

RP Alternative Global Bond Fund

| 1 MON | 3 MON | 6 MON | YTD | 1 YR | 3 YR | 5 YR | Since Inception | |

|---|---|---|---|---|---|---|---|---|

| RP Alternative Global Bond Fund (Class F) | 0.96% | 2.41% | 4.36% | 8.00% | 14.33% | 5.64% | 6.58% | 6.63% |

| FTSE Canada All Corporate Bond Index | 2.12% | 4.67% | 5.81% | 5.88% | 13.96% | 1.49% | 2.11% | 2.23% |

Source: RPIA, FTSE Russell. Data as of 09/30/2024 and annualized for periods greater than one year. SI = 07/2019.

AGB returned +2.41% during the quarter, a lower return than the FTSE Canada All Corporate Bond Index (the “Index”), which had a higher exposure to interest rates during the period.

The Fund generated outsized returns from credit spread exposure and participated well in the rally of short to intermediary risk-free yields. Credit returns were driven by positions in high-quality Yankee and global systemically important banks, as well as specialty financials like aircraft lessors. Security selection within the energy sector also generated significant returns, bucking the underperformance of global energy sector spreads at the index level. Although it was a net detractor overall, the Fund’s dynamic hedging portfolio proved its worth by notably reducing severe market volatility on several occasions during the quarter.

| Top Contributors to Credit Return (Sector) |

|---|

| Financials |

| Energy-Infrastructure |

| Consumers |

Source: RPIA. Data as of 09/30/2024.

| Top Contributors to Credit Return (Issuer) |

|---|

| Barclays PLC |

| Enbridge Inc. |

| Boeing Co/The |

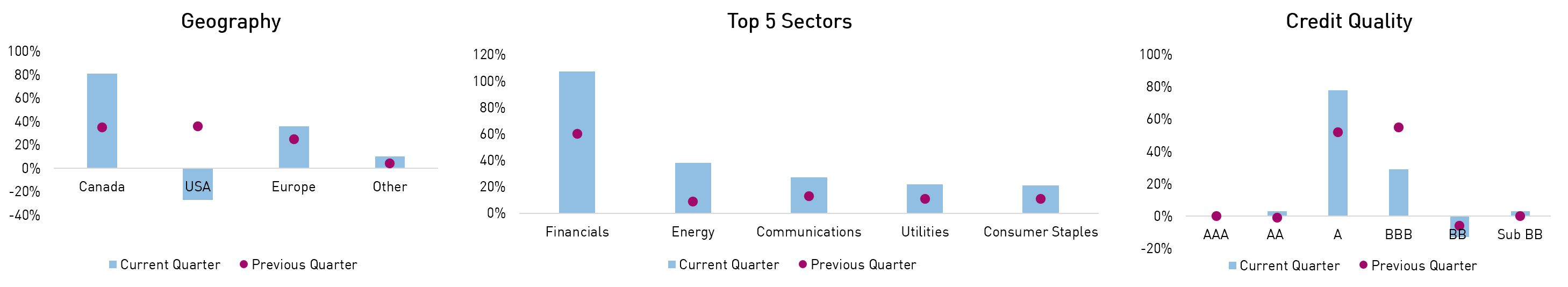

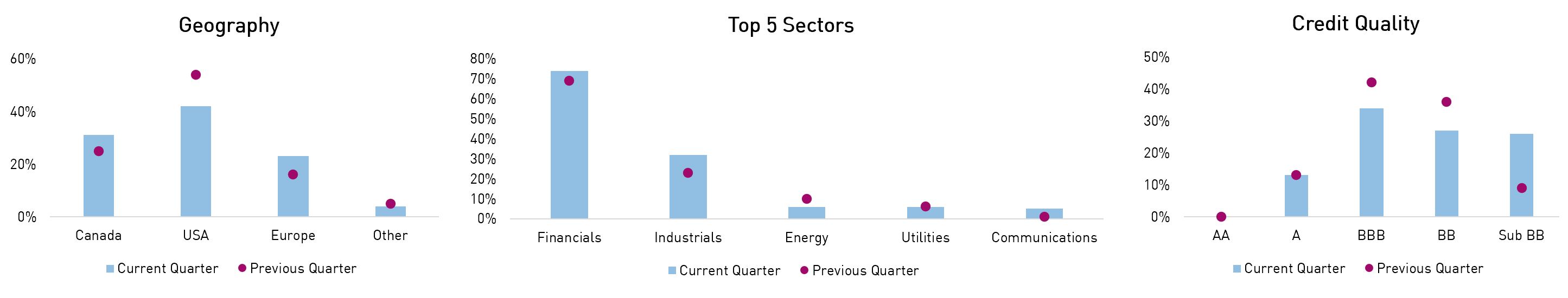

Interest rate exposure was reduced alongside the broad rally in interest rates as the investment team prepared for a more attractive entry point. Similarly, credit risk was reduced as geopolitical risks and valuation dynamics argued for a more cautious approach. Geographically, the portfolio’s US exposure turned net negative due to the large increase in hedging positions, which tend to be US-based. Given the increase in hedges, the portfolio’s sector exposures mathematically increased, but as mentioned, the overall credit risk was reduced. In terms of credit quality, the portfolio continued to move up in quality and ended the period with a net short exposure to high yield. We believe the Fund is well positioned to continue navigating the constantly changing spread and rate markets to generate strong risk-adjusted returns, given its expanded toolkit and commonsense approach.

| Q3 2024 | Q2 2024 | |

|---|---|---|

| Effective Duration (Years) | 1.1 | 3.2 |

| Credit Duration (Years) | 2.5 | 5.9 |

| Average Term (Years) | 8.8 | 7.4 |

| Net Credit Leverage | 0.5x | 1.2x |

| % Rated Investment Grade | 110% | 106% |

Source: RPIA. Data as of 09/30/2024.

Source: RPIA. Data as of 09/30/2024.

RP Debt Opportunities

| 1 MON | 3 MON | 6 MON | YTD | 1 YR | 3 YR | 5 YR | 10 YR | Since Inception | |

|---|---|---|---|---|---|---|---|---|---|

| RP Debt Opportunities | 0.69% | 1.57% | 3.43% | 6.80% | 10.84% | 5.49% | 5.29% | 5.69% | 7.73% |

| FTSE Canada All Corporate Bond Index | 2.12% | 4.67% | 5.81% | 5.88% | 13.96% | 1.49% | 2.11% | 3.12% | 4.01% |

Source: RPIA, FTSE Russell. Data as of 09/30/2024 and annualized for periods greater than one year. SI = 10/2009. RP Debt Opportunities strategy performance presented above represents a composite return of RP Debt Opportunities Fund LP Class A and RP Debt Opportunities Fund Ltd. Class A, from October 2009 to July 2011 and RP Debt Opportunities Fund Ltd. Class A. from August 2011 onwards.

DOF returned +1.57% during the quarter, a lower return than the FTSE Canada All Corporate Bond Index (the “Index”), which had a higher exposure to interest rates during the period.

The Strategy generated outsized returns from credit spread exposure, but the portfolio’s inherently low duration led to underperformance relative to more traditional fixed income that benefited from the rally in interest rates. Credit returns were driven by positions in high-quality Yankee and global systemically important banks and energy-infrastructure issuers. Other contributions were well-diversified across sectors, highlighted by Rogers Communications (telecom), Boeing (industrial), and Allied Properties (real estate) being three of the top five contributors during the quarter. Also of note, a securitized security backed by the revenue of Subway restaurants was a top ten contributor. Although they were net detractors overall, the Fund’s dynamic hedging portfolio proved its worth by notably reducing severe market volatility on several occasions during the quarter.

| Top Contributors to Credit Return (Sector) |

|---|

| Financials |

| Energy-Infrastructure |

| Real Estate |

Source: RPIA. Data as of 09/30/2024.

| Top Contributors to Credit Return (Issuer) |

|---|

| Rogers Communications Inc. |

| Enbridge Inc. |

| Barclays PLC |

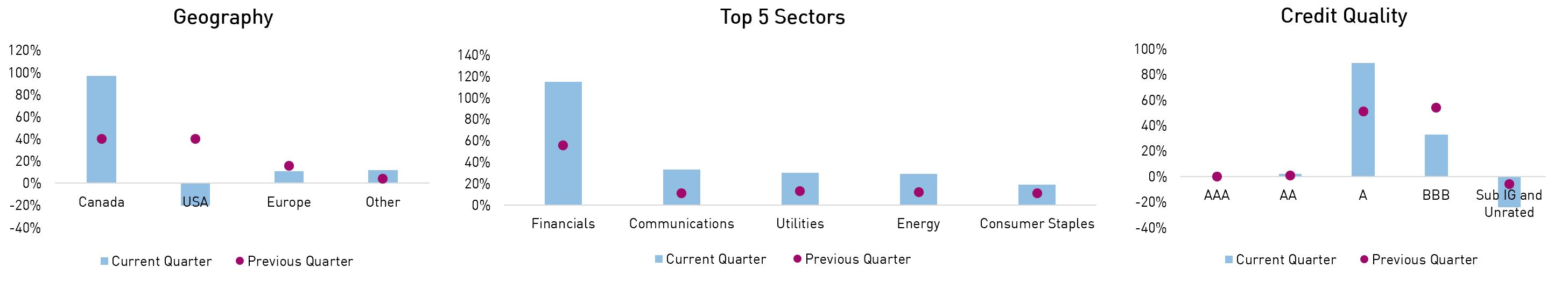

Interest rate exposure was trimmed to <1 year while credit spread exposure was notably reduced into quarter-end. More specifically, credit risk was reduced as geopolitical risks and valuation dynamics argued for a more cautious approach. Geographically, the portfolio’s US exposure turned net negative due to the large increase in hedging positions, which tend to be US-based. Given the increase in hedges, the portfolio’s sector exposures mathematically increased, but as mentioned, the overall credit risk was reduced. In terms of credit quality, the portfolio continued to move up in quality and ended the period with a net short exposure to high yield. We believe the Strategy is well positioned to continue to navigate ever-changing markets and generate strong risk-adjusted returns, given its expanded toolkit and commonsense approach.

| Q3 2024 | Q2 2024 | |

|---|---|---|

| Effective Duration (Years) | 0.7 | 1.2 |

| Credit Duration (Years) | 2.4 | 5.7 |

| Average Term (Years) | 8.4 | 4.9 |

| Net Credit Leverage | 0.5x | 1.6x |

| % Rated Investment Grade | 124% | 106% |

Source: RPIA. Data as of 09/30/2024.

Source: RPIA. Data as of 09/30/2024.

RP Select Opportunities

| 1 MON | 3 MON | 6 MON | YTD | 1 YR | 3 YR | 5 YR | 10 YR | Since Inception | |

|---|---|---|---|---|---|---|---|---|---|

| RP Select Opportunities Strategy | 1.00% | 3.03% | 5.01% | 9.80% | 14.87% | 7.96% | 9.41% | 8.68% | 8.46% |

| Bloomberg US High Yield (CAD Hedged) | 1.53% | 5.01% | 5.98% | 7.39% | 14.69% | 2.37% | 3.97% | 4.40% | 4.27% |

Source: RPIA, Bloomberg. Data as of 09/30/2024 and annualized for periods greater than one year. SI = 04/2014. RP Select Opportunities strategy performance presented above is a hypothetical illustration based on the weighted average composite return of a separately managed account utilizing a similar strategy from inception in April 2014 to May 2014, then linked to the returns of RP Select Opportunities Cayman Fund Ltd. – Class C Lead.

SOF returned +3.03% during the quarter, underperforming the Bloomberg US High Yield (CAD Hedged) Bond Index (the “Index”) due to the index’s higher exposure to interest rates.

The Strategy produced another quarter of strong results by generating outsized returns from credit spread exposure. Credit returns were primarily driven by financial-related exposures which were well-diversified between specialty financials like business development companies, diversified banks, and select consumer finance issuers. Additionally, consumer-related issuers, including homebuilders, were notable contributors as the industry’s spreads rallied alongside more friendly financial conditions. Although they were net detractors overall, the Fund’s dynamic hedging portfolio proved its worth by notably reducing severe market volatility on several occasions during the quarter.

| Top Contributors to Credit Return (Sector) |

|---|

| Financials |

| Consumers |

| Energy |

Source: RPIA. Data as of 09/30/2024.

| Top Contributors to Credit Return (Issuer) |

|---|

| Freedom Mortgage Holdings Inc. |

| Service Properties Trust |

| Spirit Aerosystems Inc. |

Interest rate exposure and credit risk were reduced quarter-over-quarter as the investment team prepared for more attractive entry points. Geographically, the portfolio increased domestic and EUR-domiciled exposures while US exposure decreased mainly due to an increase in US-based hedges. Sector-wise, financials remain the portfolio’s largest exposure, while real estate exposure was reduced in favour of adding to issuers in the industrial and communication sectors. In terms of credit quality, the portfolio’s overweight to investment grade was trimmed quarter-over-quarter as opportunities arose in select high yield issuers. We believe the Strategy is well-positioned to continue providing investors with strong risk-adjusted returns as an effective alternative to traditional fixed income, equity, and private asset allocations.

| Q3 2024 | Q2 2024 | |

|---|---|---|

| Effective Duration (Years) | 3.1 | 3.3 |

| Credit Duration (Years) | 3.3 | 4.4 |

| Average Term (Years) | 5.4 | 5.7 |

| Net Credit Leverage | 1.3x | 1.3x |

| % Rated Investment Grade | 47% | 55% |

Source: RPIA. Data as of 09/30/2024.

Source: RPIA. Data as of 09/30/2024.