In late March, Canadian insurers were hit with a surprising tax measure proposed in this year’s Federal Budget. The Budget proposed a change in the tax treatment of dividends that financial institutions - such as insurance companies - receive from Canadian companies. With this change, Canadian insurers will be expected to pay the full tax rate for common and preferred share dividends, treating them as ordinary business income.

We believe removing the tax advantage of these instruments gives insurance companies another good reason to reduce or eliminate their preferred share allocations. We believe actively managed fixed income solutions can deliver better risk-adjusted returns for P&C clients, with a much lower capital requirement.

Not-So-Preferred Shares

According to a recent report by Sunlife, Canadian property and casualty (P&C) insurers hold around 12% of all outstanding preferred shares in Canada, which equals to about $6 billion.1

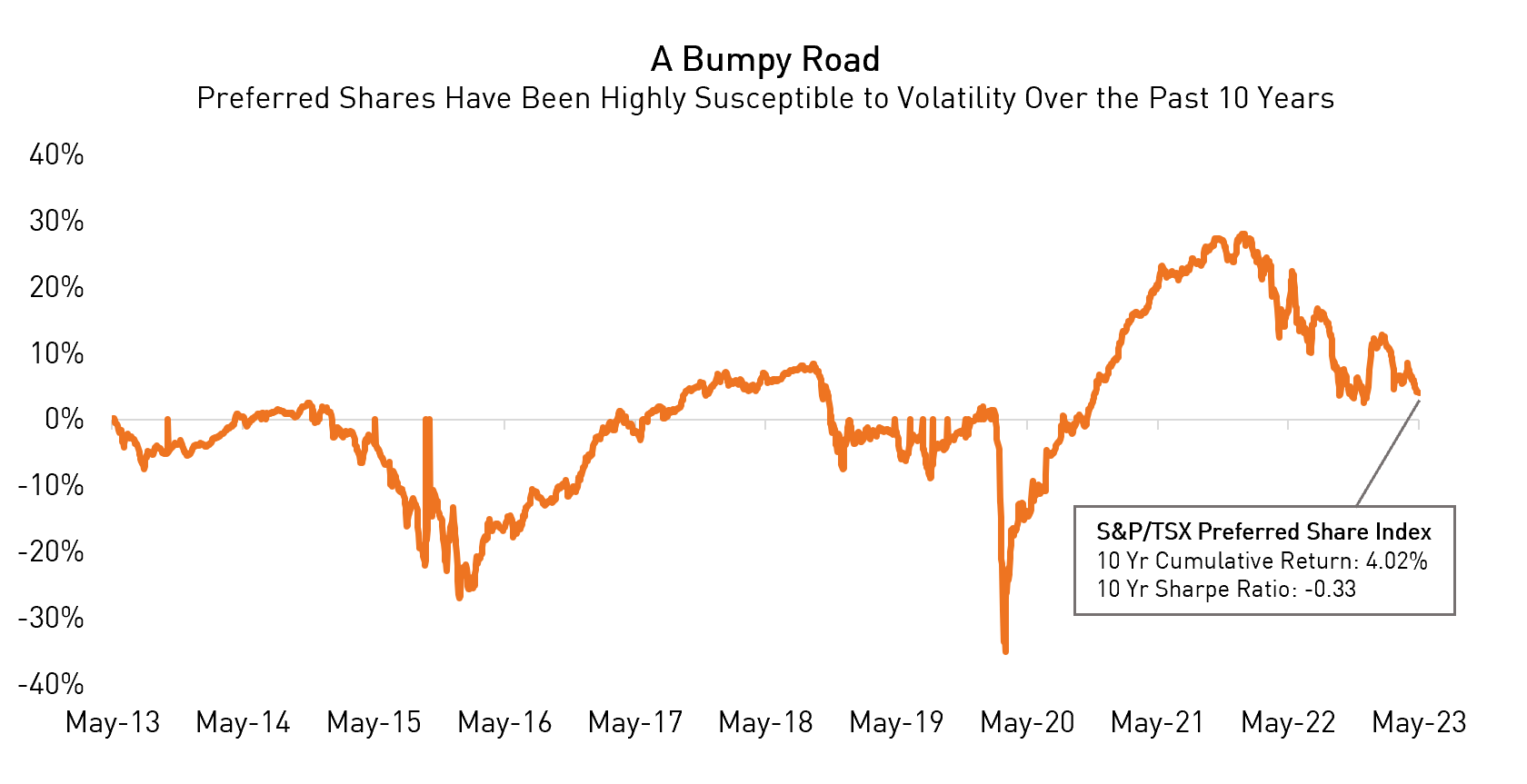

Preferred shares portfolios have delivered a meagre annualized return of 0.4% over the last 10yrs.2 Investors in preferred shares have also experienced a very bumpy ride due to the volatility in bond yields. The majority of preferred shares issued in Canada are structured as rate-reset preferred shares, meaning they have a significant correlation to moves in the 5yr Government of Canada yield. In fact, the Sharpe ratio of the Canadian Preferred Share Index (a measure of the risk-adjusted return) has actually been negative over the last decade.

Source: Source: Y Charts. S&P/TSX Preferred Share Index 10Yr Cumulative Returns. Data as of May 23, 2023.

Even with the preferential tax treatment, preferred shares have been a poor investment for insurance companies. The proposed change to the tax treatment of dividends only adds to the list of challenges.

The Case for Corporate Bonds

We believe that P&C insurance companies looking to squeeze more return from their investment portfolio should do so by increasing their allocation to actively managed fixed income. Here are three reasons why:

- After the significant increase in yields over the last year, actively managed fixed income strategies have the potential to deliver attractive investment returns for P&C firms.

- Due to the seniority of bonds in a company’s capital structure, fixed income allocations can provide portfolio resilience. This is particularly valuable given the current uncertain outlook.

- Fixed income portfolios are more capital efficient for P&C firms than other return-seeking allocations (such as high yield bonds, preferred shares, or equities).

Please reach out if you would like to discuss how we can help you with your portfolio.

1 O’Hara, C. (2023, May 17). Property insurers warn proposed federal tax change to preferred shares could hurt the sector. The Globe and Mail. https://www.theglobeandmail.com/business/article-insurers-preferred-shares-tax-change/.

2 Source: YCharts.

Important Information

The information herein is presented by RP Investment Advisors LP (“RPIA”) and is for informational purposes only. It does not provide financial, legal, accounting, tax, investment, or other advice and should not be acted or relied upon in that regard without seeking the appropriate professional advice. The information is drawn from sources believed to be reliable, but the accuracy or completeness of the information is not guaranteed, nor in providing it does RPIA assume any responsibility or liability whatsoever. The information provided may be subject to change and RPIA does not undertake any obligation to communicate revisions or updates to the information presented. Unless otherwise stated, the source for all information is RPIA. The information presented does not form the basis of any offer or solicitation for the purchase or sale of securities. Products and services of RPIA are only available in jurisdictions where they may be lawfully offered and to investors who qualify under applicable regulation. “Forward-Looking” statements are based on assumptions made by RPIA regarding its opinion and investment strategies in certain market conditions and are subject to a number of mitigating factors. Economic and market conditions may change, which may materially impact actual future events and as a result RPIA’s views, the success of RPIA’s intended strategies as well as its actual course of conduct.