The bond market is vast and complex, which makes it all the more important for bond managers to have the right tools to navigate its breadth and intricacies. In the current market environment, riddled with uncertainty and volatility, expertise and efficiency within the investment process become higher priorities.

In the early days of the firm’s formation and growth, we searched for an off-the-shelf solution that could provide our team with the right tools to conduct analysis faster and identify the optimal pricing for the securities we invest in. However, there was no such solution to be found, so we chose to build it ourselves. In 2019, we developed SANTA (Structuring Analysis & Trading Assistant), a propriety tool that:

- Facilitates portfolio structuring,

- Identifies mispriced securities, and

Improves execution efficiency.

How SANTA Fits in Our Investment Process

1. Opportunity Identification

Our Investment Committee meets weekly to set overarching investment themes, which are passed onto our credit research and execution portfolio managers to conduct fundamental analysis on companies across sectors and geographies to identify compelling opportunities. Our investment team employs a very collaborative approach to developing trade ideas by leveraging their shared expertise on various aspects of the credit market. Once an opportunity is identified, the team turns to SANTA to facilitate a more efficient trading process.

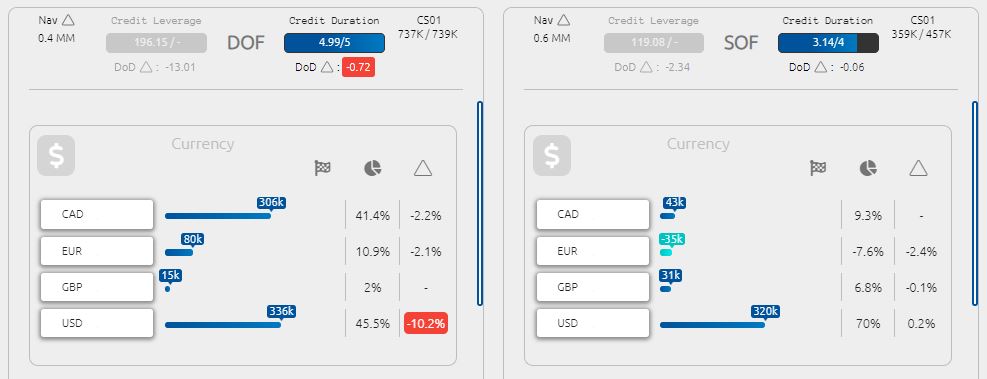

2. Portfolio Structuring

Before we can execute on a trade, we need to determine whether we can invest within the portfolio’s current risk parameters, including our exposures to the sector, credit rating, and interest rate risk of the company. SANTA allows us to instantaneously analyze our current portfolio exposures and set targets for any changes we are making to the portfolio’s holdings. This ability to quickly slice and dice our exposures to understand what we currently have in the portfolio and what we can do with the trade idea is invaluable.

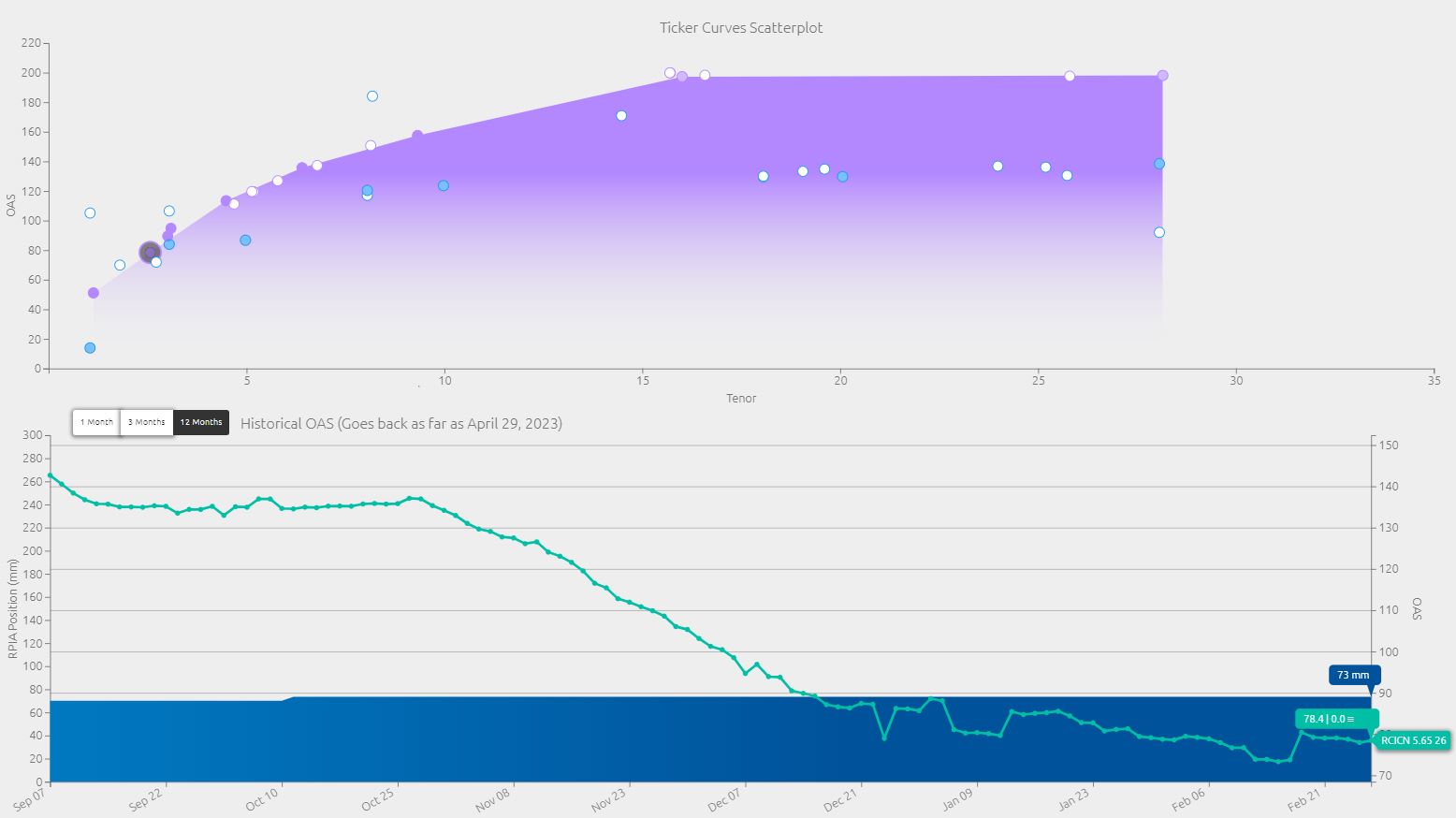

3. Security Selection Analysis

Next, we conduct credit curve analysis to quickly identify the most attractively priced securities on the chosen issuer’s credit curve. The same analysis can be carried out across geographies and sectors as well. SANTA enables us to aggregate securities data from multiple platforms, including Bloomberg, to form a more complete and accurate picture of pricing information, allowing us to identify the most mispriced securities. This is what makes our process unique. For us, security selection is less about buying any credit from the chosen company and more about buying the cheapest security so we can create additional value for our investors.

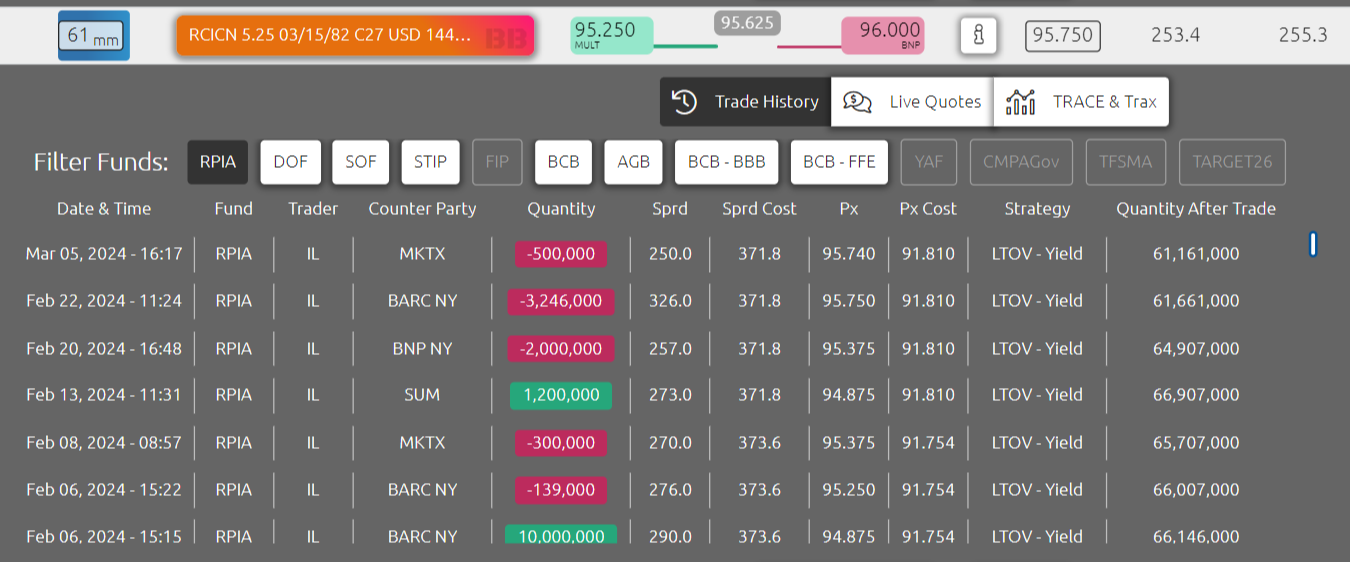

4. Trade Execution

Finally, we take a deeper look at the most attractive security we’ve identified through our analysis in the previous steps. We pay special attention to its historical trading activities, liquidity, our past positions, and who we have previously traded with and at what price. SANTA can compile this information for us to ensure we are able to select the best possible execution price. While equities trade on an open exchange, bonds do not, and the lack of price transparency results in widely varying prices. SANTA eliminates this problem by providing pricing transparency for our portfolio managers to make the most informed decisions quickly.

How SANTA Adds Value

Throughout the trading process, SANTA repeatedly adds value in three key ways:

Efficiency: The vastness of the bond market sometimes makes speed an elusive factor in decision making. SANTA is able to remove that barrier by aggregating and synthesizing considerable amounts of data so our team can make decisions faster and capitalize on opportunities in a timely manner.

Effectiveness: With SANTA, our team can focus on what they do best – leveraging their knowledge and expertise to conduct analysis and develop trade ideas.

- Collaboration: SANTA facilitates a highly collaborative trading platform that is conducive to sharing fresh ideas across teams, identifying the best opportunities, executing trades, and managing risk.

Being Truly Active

We pride ourselves in our highly active approach to managing fixed income. In an ever-changing economic landscape that has recently been riddled with uncertainty and volatility, our process enables us to manage the constantly changing variables in the market and capitalize on our best ideas. Technology plays a key role in how we can be truly active while maintaining a repeatable and disciplined process that balances alpha generation with robust risk management.

Important Information

The information herein is presented by RP Investment Advisors LP (“RPIA”) and is for informational purposes only. It does not provide financial, legal, accounting, tax, investment, or other advice and should not be acted or relied upon in that regard without seeking the appropriate professional advice. The information is drawn from sources believed to be reliable, but the accuracy or completeness of the information is not guaranteed, nor in providing it does RPIA assume any responsibility or liability whatsoever. The information provided may be subject to change and RPIA does not undertake any obligation to communicate revisions or updates to the information presented. Unless otherwise stated, the source for all information is RPIA. The information presented does not form the basis of any offer or solicitation for the purchase or sale of securities. Products and services of RPIA are only available in jurisdictions where they may be lawfully offered and to investors who qualify under applicable regulation.

“Forward-Looking” statements are based on assumptions made by RPIA regarding its opinion and investment strategies in certain market conditions and are subject to a number of mitigating factors. Economic and market conditions may change, which may materially impact actual future events and as a result RPIA’s views, the success of RPIA’s intended strategies as well as its actual course of conduct.