Over the past few years, substantial rate hikes led investors to favour GICs, which, during that period, served as a transitional asset allocation, offering a stable return against the backdrop of volatile bond valuations. Now, however, as global central banks have begun cutting rates, the opportunity cost of choosing GICs over short-dated bonds has increased.

The falling interest rate environment, combined with changes in Canadian taxation, has made bonds a relatively better investment than GICs. In light of these changes, we believe investors must reconsider their asset allocation strategy.

As GICs mature and investors are faced with lower rates and higher taxes, there are three key factors that underscore asset allocation decisions: return potential, tax efficiency, and liquidity.

1. Active Bond Strategies Have Better Return Potential Than GICs

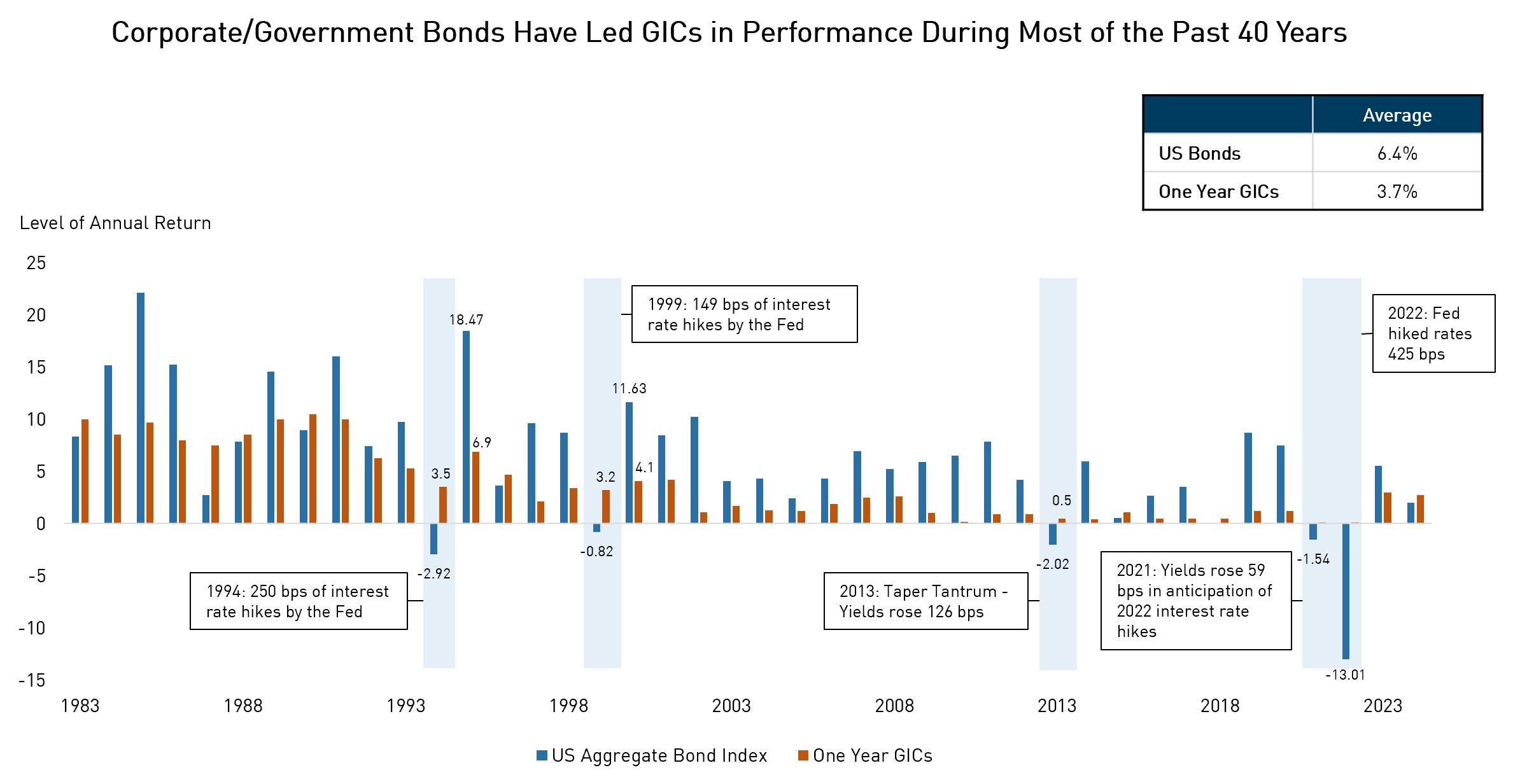

Over the past 40 years, bond returns have exceeded those of one-year GICs in 29 out of 40 years; in other words, almost 75% of the time. Notably, the few years of bond underperformance versus GICs occurred during years of rising interest rates. Now, as central banks have begun cutting rates and signaling more rate cuts ahead, the risk of further rate-induced bond underperformance has diminished significantly. In fact, in the years following rate hiking cycles, bond returns have recovered nicely – more specifically, in 1995, 2000, and 2014, when the US Aggregate Bond Index generated more than twice the return as one-year GICs.

Source: BarclaysLive, YCharts. Data as of July 31, 2024.

2. Bonds Have Tax Efficiencies for Non-Registered Accounts

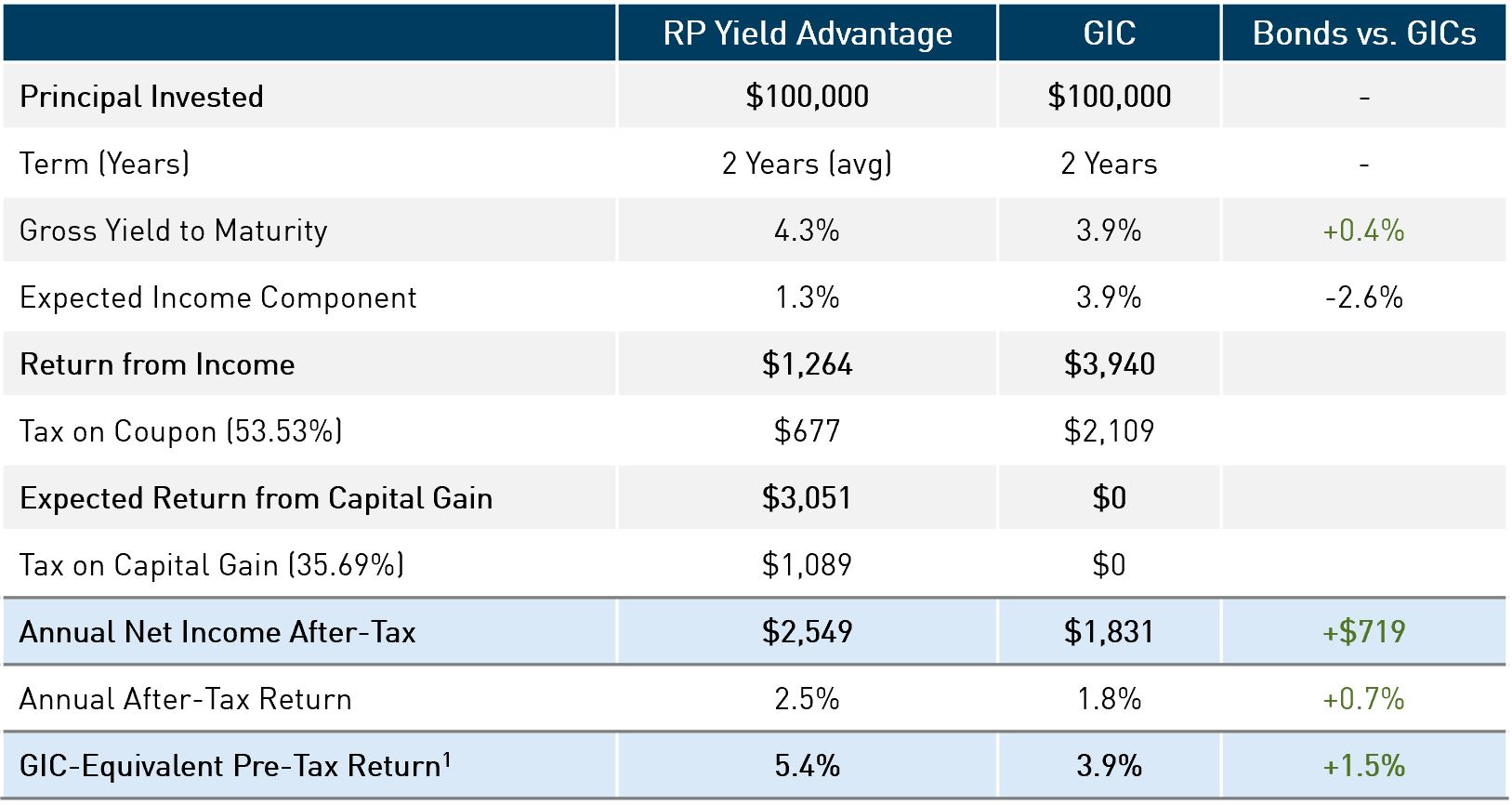

GIC returns are derived entirely from income payments, which are fully taxed at the investor’s marginal income tax rate in non-registered accounts. On the other hand, the total returns for corporate bonds may encompass both coupon payments (taxed as income) and capital appreciation (taxed favourably as capital gains). As an example, the RP Yield Advantage portfolio strategically focuses on high-quality discounted corporate bonds, with a significant amount of the fund’s total expected return coming from capital appreciation when these bonds are “pulled to par.”

The sample comparison below illustrates the relative tax efficiency of an active bond strategy like RP Yield Advantage compared to a GIC with a similar term.

For illustrative purposes only. 1GIC-Equivalent Pre-Tax Return is an approximation derived from current market yield levels and may or may not be realized. It is not the same as the portfolio’s yield to maturity; it is estimated as the after-tax pull-to-par yield using tax rates based on a 67% inclusion rate and an Ontario resident in the highest tax bracket (i.e., 53.53% interest income and 35.69% net on capital gains). The GIC-Equivalent Yield could change for individuals who have net capital gains in excess of $250,000 or hold units in a corporate account. Please refer to your tax accountant for individual advice.

3. Bonds Offer Liquidity Without Penalty Unlike GICs

Locked-in GICs have significant penalties for early withdrawal, whereas, with an actively managed corporate bond fund, you can access your money within days of redeeming. Given the mixed macroeconomic data, geopolitical tensions, and looming election

risks, markets will likely continue to be riddled with uncertainty. Investors may benefit from being able to quickly and opportunistically rebalance their portfolios using the funding from bond allocations, which would be difficult if the capital

is locked up in non-redeemable GICs. An active corporate bond strategy can allow investors the flexibility to change their minds without penalty.

In Closing

Investors often exhibit a cognitive bias known as “recency bias,” which involves basing future expected performance on recent performance, whether positive or negative. In this context, investors may have experienced negative returns in bonds and expect the recent relative attractiveness of GICs to persist. However, the tide has turned; central banks have begun cutting rates, and bond strategies are once again outperforming GICs. Historically, falling rates have proven to be fertile ground for active managers to generate strong returns and offset many of the risks GICs are prone to in such an environment. As the Fed is expected to cut rates over the remainder of 2024, we believe the coming months will offer attractive opportunities for our team to execute and generate strong risk-adjusted returns.

Important Information

The information herein is presented by RP Investment Advisors LP (“RPIA”) and is for informational purposes only. It does not provide financial, legal, accounting, tax, investment, or other advice and should not be acted or relied upon in that regard without seeking the appropriate professional advice. The information is drawn from sources believed to be reliable, but the accuracy or completeness of the information is not guaranteed, nor in providing it does RPIA assume any responsibility or liability whatsoever. The information provided may be subject to change and RPIA does not undertake any obligation to communicate revisions or updates to the information presented. Unless otherwise stated, the source for all information is RPIA. The information presented does not form the basis of any offer or solicitation for the purchase or sale of securities. Products and services of RPIA are only available in jurisdictions where they may be lawfully offered and to investors who qualify under applicable regulation. The RPIA managed investment strategies discussed herein may be available to qualified Canadian investors through private and/or publicly offered investment funds. Eligibility and suitability of investing in these funds must be determined by registered dealing representatives of RPIA or third-party dealers.

“Forward-Looking” statements are based on assumptions made by RPIA regarding its opinion and investment strategies in certain market conditions and are subject to a number of mitigating factors. Economic and market conditions may change, which may materially impact actual future events and as a result RPIA’s views, the success of RPIA’s intended strategies as well as its actual course of conduct.