Our Latest Market Updates

Out With a Whisper, In With a Bang - Q4 2025 Notes from the Trading Desk

Credit Market Themes in 5 Charts - Q4 2025

RP Strategic Income Plus Fund

| 1 MON | 3 MON | 6 MON | YTD | 1 YR | 3 YR | 5 YR | Since Inception | |

|---|---|---|---|---|---|---|---|---|

| RP Strategic Income Plus Fund (Class F) | -0.81% | -0.20% | 1.71% | 4.07% | 4.07% | 5.58% | 2.53% | 3.79% |

| FTSE Canada All Corporate Bond Index | -0.59% | 0.34% | 2.16% | 4.48% | 4.48% | 6.60% | 1.49% | 3.14% |

Source: RPIA, FTSE Russell. Data as of 12/31/2025 and annualized for periods greater than one year. SI = 04/2016.

STIP returned -0.20% during the quarter, underperforming the FTSE Canada All Corporate Bond Index (the “Index”).

The Fund generated positive returns from credit spread exposure; however, rising risk-free yields, particularly in Canada, weighed on total returns during the period. The portfolio’s domestic credit exposure performed well as Canadian spreads outperformed their US counterparts, which struggled to digest an onslaught of AI-related debt issuance. Credit returns were driven by spread compression in CAD-denominated utilities, largely concentrated within energy infrastructure issuers. Positions in domestic systemically important banks, including subordinated USD-denominated bank debt issued by BMO, performed notably well. Technology exposure experienced mark-to-market losses as concerns around future capex and potential debt issuance weighed on the sector’s valuation.

| Top Contributors to Credit Return (Sector) |

|---|

Utilities |

Financials |

| Energy Infrastructure |

Source: RPIA. Data as of 12/31/2025.

| Top Contributors to Credit Return (Issuer) |

|---|

| BPC Generation Infrastructure Trust |

| Electricite de France SA |

| Telus Corp. |

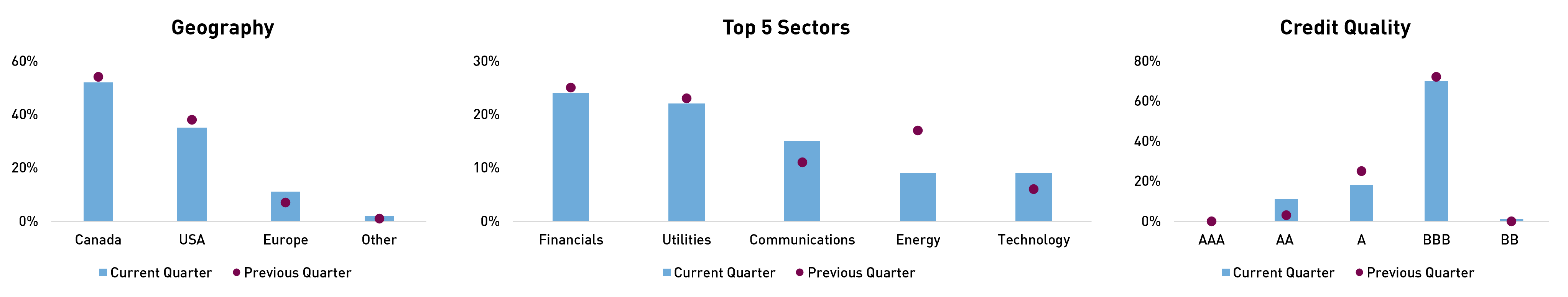

The portfolio’s interest rate exposure remained elevated relative to its historical average, ranging between 5.0 and 5.8 years of duration. While credit exposure increased in late November, spread risk remained subdued overall and was reduced into year-end in anticipation of an active new-issue calendar in early 2026. The portfolio was relatively unchanged from a geographic perspective, favouring lower beta Canadian credit risk as we await better opportunities abroad. Sector-wise, the portfolio trimmed well-performing energy infrastructure positions and rotated into attractively priced TMT-related issuers that we hold high-conviction in. Quality-wise, the portfolio is nearly 100% investment grade and carries a healthy amount of government-related exposure, given tight credit spread valuations. We believe the Fund can add meaningful alpha from both interest rate and credit spread exposure, underpinned by elevated all-in yields and a coming pickup in credit spread dispersion during 2026.

| Q4 2025 | Q3 2025 | |

|---|---|---|

| Effective Duration (Years) | 5.7 | 5.6 |

| Credit Duration (Years) | 3.4 | 4.1 |

| % Rated Investment Grade | 99% | 100% |

Source: RPIA. Data as of 12/31/2025.

Source: RPIA. Data as of 12/31/2025.

RP Alternative Global Bond Fund

| 1 MON | 3 MON | 6 MON | YTD | 1 YR | 3 YR | 5 YR | Since Inception | |

|---|---|---|---|---|---|---|---|---|

| RP Alternative Global Bond Fund (Class F) | -0.46% | 0.06% | 2.46% | 6.09% | 6.09% | 7.93% | 5.83% | 6.43% |

| FTSE Canada All Corporate Bond Index | -0.59% | 0.34% | 2.16% | 4.48% | 4.48% | 6.60% | 1.49% | 2.64% |

Source: RPIA, FTSE Russell. Data as of 12/31/2025 and annualized for periods greater than one year. SI = 07/2019.

AGB returned +0.06% during the quarter, underperforming the FTSE Canada All Corporate Bond Index (the “Index”).

The Fund generated positive returns from credit exposure despite a selloff in US investment grade spreads. The portfolio’s active management of interest rate exposure limited the adverse effect of rising risk-free yields on bond prices. High-quality USD-denominated global systemically important banks and Yankee banks led credit returns. Domestic systemically important banks, as well as a new issue from First National Financial that saw spreads rally by more than 40bps, delivered strong returns. The portfolio’s holdings of Spirit AeroSystems bonds rallied materially after being taken out at a significant premium upon completion of Boeing's acquisition, validating our more than two-year trade thesis and generating a strong payoff. The Fund’s hedges were net detractors overall, but they provided downside protection during swift selloffs in early October and mid-November.

| Top Contributors to Credit Return (Sector) |

|---|

| Financials |

| Consumer Discretionary |

| Consumer Staples |

Source: RPIA. Data as of 12/31/2025.

| Top Contributors to Credit Return (Issuer) |

|---|

| UBS Group AG |

| Lloyds Banking Group PLC |

| Enbridge Inc. |

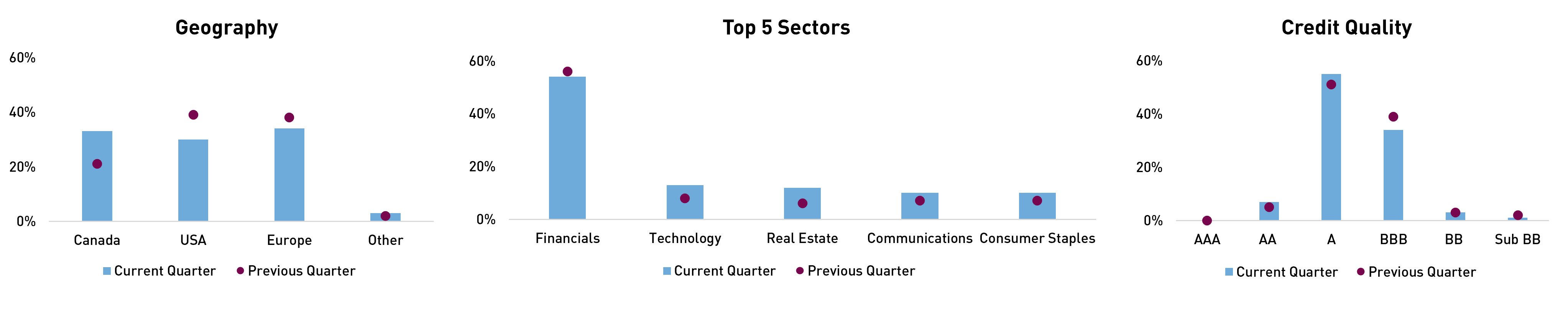

Interest rate exposure was managed actively between 0 and 6.0yrs of duration, ultimately finishing the year at 5.7yrs, which is well above the portfolio’s historical average. Alternatively, credit risk remained muted, with the exception of a tactical increase in late November that was materially reduced heading into year-end, in anticipation of an active new-issue calendar in early 2026. Geographically, the portfolio reduced non-Canadian credit in favour of rotating into lower-beta domestic exposures. Sector-wise, single-name shorts in cyclical sectors such as consumer discretionary and materials increased, while opportunities within real estate and TMT debt were added. In terms of credit quality, the portfolio remains up-in-quality with only ~4% high yield exposure and embedded downside protection through credit hedges. We believe the Fund is well-positioned to continue navigating the increasingly volatile market given its flexible and opportunistic approach.

| Q4 2025 | Q3 2025 | |

|---|---|---|

| Effective Duration (Years) | 5.7 | 3.1 |

| Credit Duration (Years) | 0.9 | 1.8 |

| Net Credit Leverage | 0.2x | 0.4x |

| % Rated Investment Grade | 96% | 96% |

Source: RPIA. Data as of 12/31/2025.

Source: RPIA. Data as of 12/31/2025.

RP Alternative Credit Opportunities Fund

| Top Contributors to Credit Return (Sector) |

|---|

| Financials |

| Industrials |

| Real Estate |

Source: RPIA. Data as of 12/31/2025.

| Top Contributors to Credit Return (Issuer) |

|---|

| Avianca Midco 2 PLC |

| BBVA Mexico SA Institucion de Banca Multiple Grupo Financiero BBVA Mexico/TX |

| PRA Group Inc. |

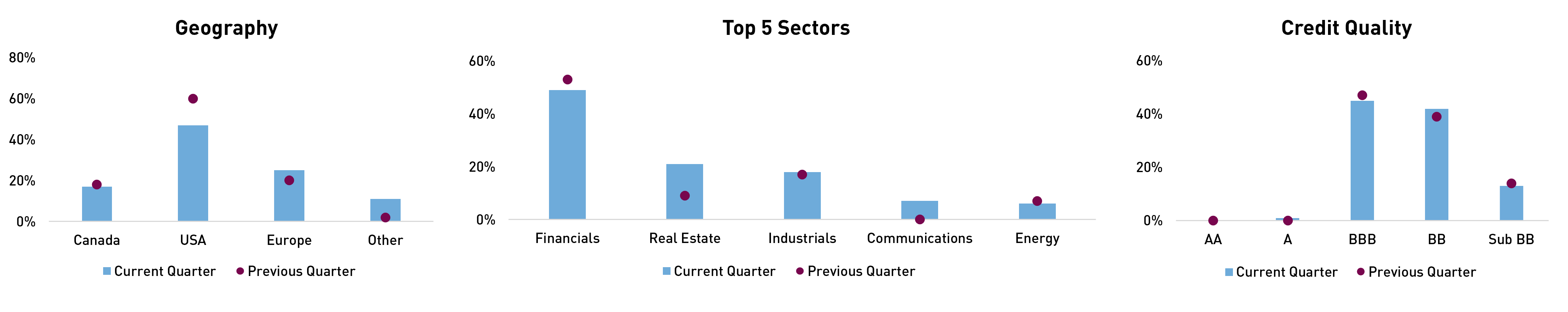

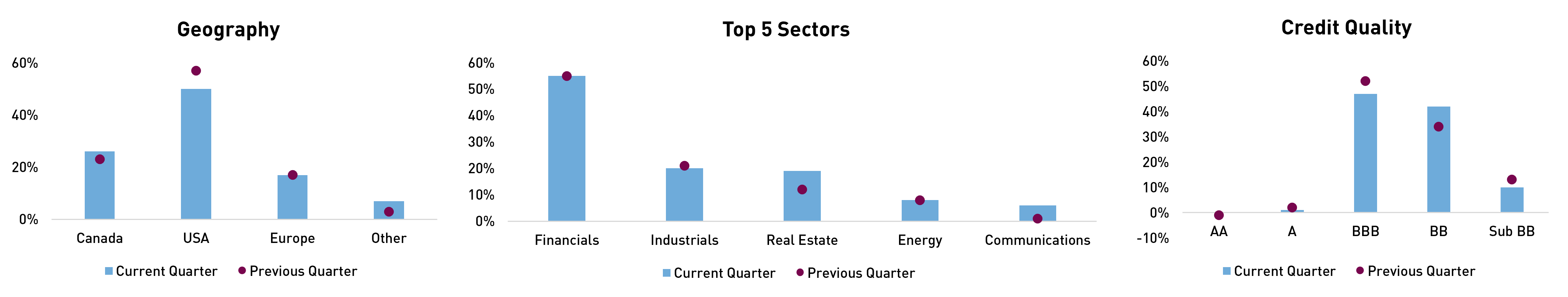

Credit risk remained subdued during the quarter, opting to isolate unique opportunities rather than embed broad market exposure at expensive valuations. Geographically, the portfolio monetized well-performing US-domiciled credit in favour of rotating into non-North American opportunities. From a sector perspective, the portfolio increased exposure to attractive opportunities in real estate and telecoms, while rotating to a net short position in more vulnerable consumer discretionary issuers. The portfolio remains split between investment grade and high yield exposures, while the latter is fully concentrated on the BB and B-rated bonds, continuing to opt against diving into lower-quality segments of the market. We believe the portfolio’s more conservative stance sets us up to take advantage of compelling opportunities as they emerge. In the meantime, we aim to continue providing investors with an effective alternative to traditional fixed income, equity, and private asset allocations.

| Q4 2025 | Q3 2025 | |

|---|---|---|

| Effective Duration (Years) | 2.9 | 3.1 |

| Credit Duration (Years) | 1.9 | 1.8 |

| Average Term (Years) | 3.9 | 4.5 |

| Net Credit Leverage | 0.6x | 0.9x |

| % Rated Investment Grade | 45% | 53% |

Source: RPIA. Data as of 12/31/2025.

Source: RPIA. Data as of 12/31/2025.

RP Debt Opportunities

| 1 MON | 3 MON | 6 MON | YTD | 1 YR | 3 YR | 5 YR | 10 YR | Since Inception | |

|---|---|---|---|---|---|---|---|---|---|

| RP Debt Opportunities | -0.41% | 0.00% | 1.73% | 3.64% | 3.64% | 6.88% | 5.22% | 5.65% | 7.44% |

| FTSE Canada All Corporate Bond Index | -0.59% | 0.34% | 2.16% | 4.48% | 4.48% | 6.60% | 1.49% | 3.21% | 4.05% |

Source: RPIA, FTSE Russell. Data as of 12/31/2025 and annualized for periods greater than one year. SI = 10/2009. RP Debt Opportunities strategy performance presented above represents a composite return of RP Debt Opportunities Fund LP Class A and RP Debt Opportunities Fund Ltd. Class A, from October 2009 to July 2011 and RP Debt Opportunities Fund Ltd. Class A. from August 2011 onwards.

DOF returned +0.00% during the quarter, underperforming the FTSE Canada All Corporate Bond Index (the “Index”).

The Strategy generated returns from credit spread exposures despite a selloff in US investment grade spreads. The portfolio’s active management of interest rate exposure and focus on the front-end of the yield curve limited the adverse effect of rising risk-free yields on bond prices. The portfolio’s CAD-denominated exposure drove credit returns, given the outperformance of domestic investment grade spreads. Still, high-quality USD-denominated, global systemically important banks and Yankee banks led credit returns. Domestic systemically important banks, as well as a new issue from First National Financial that saw spreads rally by more than 40 bps, delivered solid returns. The portfolio’s holdings of Spirit AeroSystems bonds rallied materially after being taken out at a significant premium upon completion of Boeing's acquisition, validating our more than two-year trade thesis and generating a strong payoff. The Strategy’s hedges were net detractors overall, but they provided downside protection during swift selloffs in early October and mid-November.

| Top Contributors to Credit Return (Sector) |

|---|

| Financials |

| Consumer Discretionary |

| Real Estate |

Source: RPIA. Data as of 12/31/2025.

| Top Contributors to Credit Return (Issuer) |

|---|

| UBS Group AG |

| First National Financial Corp. |

| Lloyds Banking Group PLC |

The portfolio’s interest rate duration ranged from 0.5 to 4.2 years during the period and ultimately finished near the higher end of that range, well above its historical average. Alternatively, credit risk remained muted, with the exception of a tactical increase in late November that was materially reduced heading into year-end, in anticipation of an active new-issue calendar in early 2026. Geographically, US-domiciled credit was trimmed in favour of rotating into attractive opportunities within the European investment grade market. Sector-wise, the portfolio reduced longs and added to single-name short exposures in more cyclical consumer discretionary and energy issuers. In turn, the portfolio added to high-conviction positions in financials, real estate, and attractive TMT-related credit. The portfolio further monetized BBB rated credit and rotated up the quality spectrum into A rated exposures. The Strategy remains nearly 100% investment grade exposures and carries a healthy amount of hedges that embed downside protection. We believe the Strategy is well-positioned to continue navigating ever-changing markets and generating strong risk-adjusted returns as we await more attractive entry points to increase credit exposure.

| Q4 2025 | Q3 2025 | |

|---|---|---|

| Effective Duration (Years) | 4.2 | 2.2 |

| Credit Duration (Years) | 0.8 | 1.8 |

| Net Credit Leverage | 0.2x | 0.4x |

| % Rated Investment Grade | 99% | 96% |

Source: RPIA. Data as of 12/31/2025.

Source: RPIA. Data as of 12/31/2025.

RP Select Opportunities

| 1 MON | 3 MON | 6 MON | YTD | 1 YR | 3 YR | 5 YR | 10 YR | Since Inception | |

|---|---|---|---|---|---|---|---|---|---|

| RP Select Opportunities Strategy | 0.37% | 0.77% | 4.20% | 4.35% | 4.35% | 9.36% | 8.44% | 8.46% | 8.02% |

| Bloomberg US High Yield (CAD Hedged) | 0.40% | 0.83% | 2.93% | 6.78% | 6.78% | 8.79% | 3.63% | 5.64% | 4.37% |

Source: RPIA, Bloomberg. Data as of 12/31/2025 and annualized for periods greater than one year. SI = 04/2014. RP Select Opportunities strategy performance presented above is a hypothetical illustration based on the weighted average composite return of a separately managed account utilizing a similar strategy from inception in April 2014 to May 2014, then linked to the returns of RP Select Opportunities Cayman Fund Ltd. – Class C Lead.

SOF returned +0.77% during the quarter, modestly unperforming the Bloomberg US High Yield (CAD Hedged) Bond Index (the “Index”).

The Strategy generated outsized returns from credit spread exposure on an absolute and relative basis despite high yield spreads widening +40 basis points intra-quarter before rallying into year-end. Credit returns were primarily driven by financial-related exposures, which were split between specialty financials, banks, insurance companies, and aircraft lessors. Positions within industrials performed well, including airport operator and energy infrastructure debt, as well as the portfolio’s holdings in Spirit AeroSystems bonds, which rallied materially after being taken out at a significant premium following the completion of Boeing’s acquisition. Additional contributions were driven by high-conviction positions in select real estate issuers, alongside continued credit spread compression in the portfolio’s Avianca airline debt. The Strategy’s dynamic hedges were net detractors overall, though they played an important role in limiting volatility.

| Top Contributors to Credit Return (Sector) |

|---|

| Financials |

| Industrials |

| Real Estate |

Source: RPIA. Data as of 12/31/2025.

| Top Contributors to Credit Return (Issuer) |

|---|

| Service Properties Inc. |

| Spirit Aerosystems Inc. |

| PRA Group Inc. |

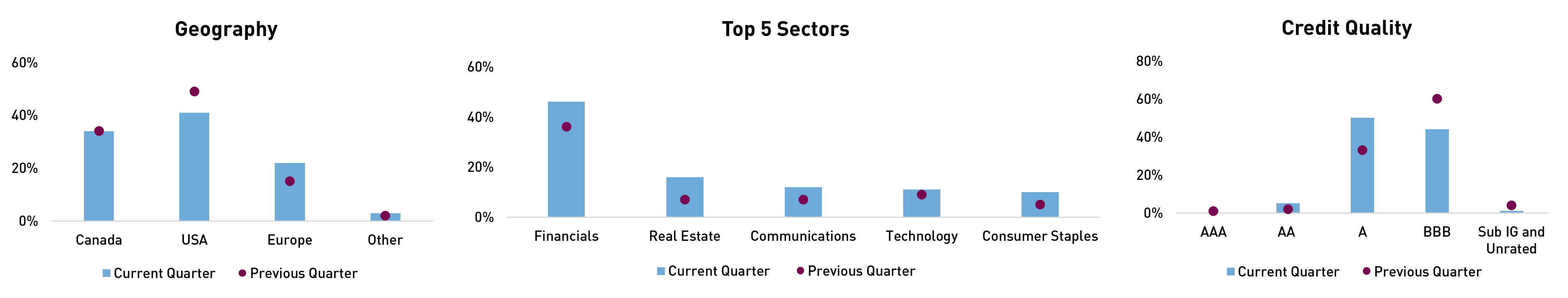

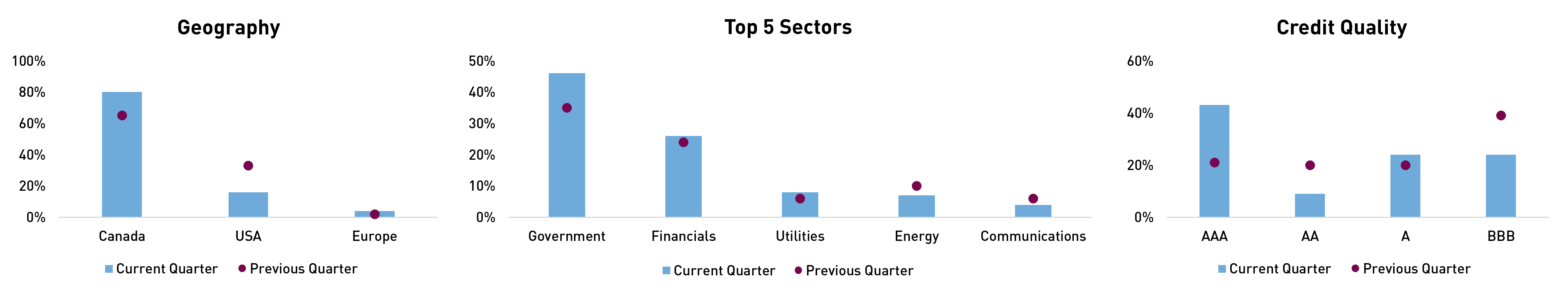

Credit risk remained subdued during the quarter, opting to isolate unique opportunities rather than embed broad market exposure at expensive valuations. Geographically, the portfolio monetized well-performing US credit in favour of rotating into lower-beta domestic exposures and non-North American opportunities. Sector-wise, single-name shorts were implemented or added to within the more cyclical consumer discretionary and material sectors. The portfolio remains nearly 50% investment grade, and high yield exposure is fully concentrated in BB and B rated bonds, continuing to opt against diving into lower quality segments of the market. We believe the portfolio’s more conservative stance sets us up to take advantage of compelling opportunities as they emerge. In the meantime, we aim to continue providing investors with an effective alternative to traditional fixed income, equity, and private asset allocations.

| Q4 2025 | Q3 2025 | |

|---|---|---|

| Effective Duration (Years) | 4.0 | 3.1 |

| Credit Duration (Years) | 1.6 | 1.8 |

| Net Credit Leverage | 0.8x | 0.9x |

| % Rated Investment Grade | 48% | 53% |

Source: RPIA. Data as of 12/31/2025.

Source: RPIA. Data as of 12/31/2025.

RP Fixed Income Plus

| 1 MON | 3 MON | 6 MON | YTD | 1 YR | 3 YR | 5 YR | 10 YR | Since Inception | |

|---|---|---|---|---|---|---|---|---|---|

| RP Fixed Income Plus | -0.18% | 0.34% | 1.75% | 4.40% | 4.40% | 5.15% | 2.81% | 2.76% | 3.64% |

| FTSE Canada Universe Short-Term Bond Index | -0.25% | 0.33% | 1.65% | 3.88% | 3.88% | 4.86% | 1.85% | 2.06% | 2.34% |

| Added Value | +0.07% | +0.01% | +0.10% | +0.52% | +0.52% | +0.29% | +0.96% | +0.70% | +1.30% |

Source: RPIA. FTSE Russell. Data as of 12/31/2025 and annualized for periods greater than one year. SI = 07/2010. RP Fixed Income Plus strategy performance presented above represents a weighted-average composite return of separately managed accounts utilizing a similar strategy from inception in July 2010 to April 2013 and linked to the returns of the RP Fixed Income Plus Fund, Series A thereafter.

FIP returned +0.34% during the quarter, performing roughly in line with the FTSE Canada Universe Short-Term Bond Index (the “Index”).

The Strategy generated positive returns from interest rates and credit spreads, and both exposures contributed to relative outperformance versus the Index. Credit returns were driven by domestic systemically important banks and high-conviction positions in Canadian energy utilities like Inter Pipeline and Enbridge. Positions in short-dated, CAD-denominated Ford bonds and USD-denominated Hyundai bonds generated alpha during the period.

| Top Contributors to Credit Return (Sector) |

|---|

| Financials |

| Utilities |

| Auto |

Source: RPIA. Data as of 12/31/2025.

| Top Contributors to Credit Return (Issuer) |

|---|

Royal Bank of Canada |

| Canada Imperial Bank of Commerce |

| Toronto Dominion Bank/The |

Overall credit exposure was reduced heading into year-end in anticipation of significant increased supply in early 2026 and generally uncompelling credit-spread valuations. From a geographic perspective, the portfolio monetized US credit and primarily rotated into domestic government-related exposures. Accordingly, the portfolio’s BBB-rated credit exposures were reduced further in favour of AAA-rated exposures. We believe the Strategy continues to offer investors a high-quality value proposition, given its 46% government bond exposure and healthy yield of 3.2%, more than +27bps greater than the Index’s yield.

| Q4 2025 | Q3 2025 | |

|---|---|---|

| Effective Duration (Years) | 2.8 | 3.0 |

| Credit Duration (Years) | 1.7 | 2.1 |

| Average Term (Years) | 3.1 | 3.3 |

| % Rated Investment Grade | 100% | 100% |

Source: RPIA. Data as of 12/31/2025.

Source: RPIA. Data as of 12/31/2025.